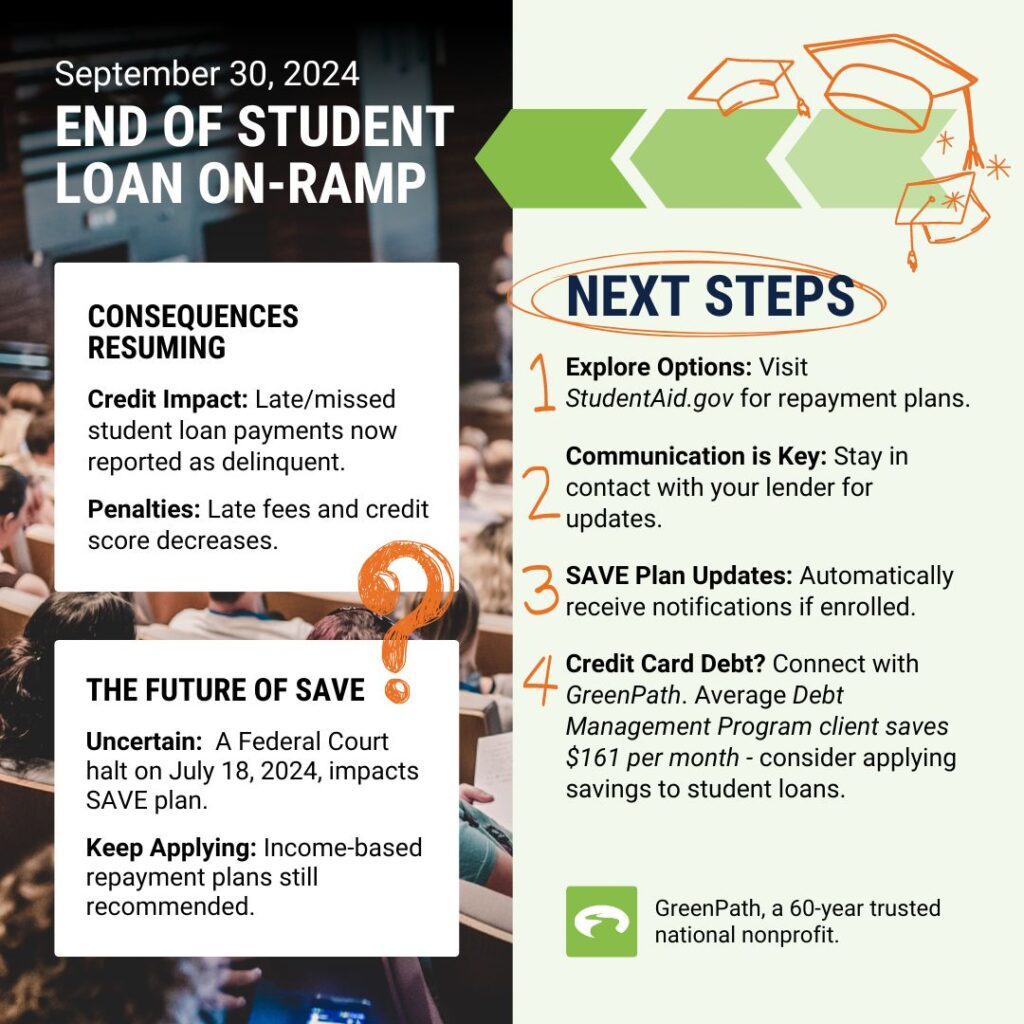

During the COVID pandemic, federal student loan payments and – crucially – interest charges were paused for nearly three years. When the pause ended, there was a historically unprecedented return to payments for 45 million Americans. To ease the transition, an On-Ramp period was implemented.

Consequences for Late and Incomplete Payments

If borrowers missed payments or made partial payments during the On-Ramp period, interest continued to accrue on their loans but were not reported as delinquent to credit bureaus (with the aim of easing the transition for those who missed payments over the last year.) Now that the On-Ramp is ending, consequences for late, missed, or partial payments have resumed. Those consequences may include late fees, delinquency notation on credit reports, and decreases to credit score.

If fitting your student loan payment back into your budget has been challenging, you’re not alone. There may be options for you if your payment is currently unaffordable. Some income-based repayment plans are in limbo right now (we’ll cover that below), but you can still visit StudentAid.gov to review your specific options.

Maintain Communication with Your Lender

We speak to people every day who are feeling stressed or overwhelmed with debt. We understand the desire to avoid or leave it for another day, but strongly encourage you to stay in contact with your student loan lenders. Student loan forgiveness and repayment are changing rapidly while politicians and courts each try to influence outcomes. It’s advantageous for student loan companies to be able to communicate with you…you might be surprised to learn what you might qualify for when it comes to loan forgiveness.

If you’re enrolled on the SAVE Plan, you’ll get automatic updates about the status of the program. With the On-Ramp ending, there is less grace if you miss a payment, so you’ll want to receive notifications of due dates and payment amounts. Whatever your situation, being in communication with your lenders is key.

The Future of SAVE is Uncertain

With an onslaught of recent political headlines, you may have missed a story about federal court decisions on the Saving on Valuable Education (SAVE) Plan. As of this publishing, StudentAid.gov has this statement on their website:

“On July 18th, 2024, a Federal Court issued a stay preventing the Department of Education from operating the SAVE Plan. We are assessing the ruling and will be in touch directly with borrowers about how this will affect them.”

– via StudentAid.gov

The SAVE Plan was designed to reduce student loan payments on federal loans to 5% of a borrower’s discretionary income. For those below a certain income threshold, the payment due was reduced to $0 per month. There were several other features of the plan all designed to reduce student loan burden on borrowers.

The future of this program is uncertain, and the story is still developing. At GreenPath, we still recommend applying for income-based student loan repayment plans. Unfortunately, right now it may take a while for federal applications to be processed.

Review Your Budget

Considering the complexities of the SAVE Plan, now is an excellent time to review your household budget. GreenPath suggests beginning by examining your expenses from the past 30 days. You might find that you’re spending more in certain areas than you realized. When you add everything up, you may discover a substantial portion of your monthly budget goes toward credit card minimum payments. If this sounds familiar, you’re not alone, and there is support available.

Reach Out

In a recent analysis of GreenPath Debt Management Program (DMP) clients, we found the average client paid $522 a month on credit cards before enrolling in the DMP. Post-enrollment, clients paid $361 per month on average. GreenPath DMP clients see an average reduction in monthly payments of $161. That $161 could be put towards paying off student loans or another area in your budget.

Whether you’ve been paying your student loans regularly for the last year or are waiting on court decisions, today is a good day to review your expenses compared to your income. If your budget isn’t quite balancing and you need some direction, we encourage you to connect with our empathetic, NFCC-certified counselors who can help create a personalized plan that works for your current financial situation.

First published by Kathryn Ellywicz and our trusted financial wellness partners at Greenpath.com

The material and information contained here is for general information purposes only. You should not rely upon the material or information on the website as a basis for making any business, legal, or any other decisions.

Whilst we endeavor to keep the information up to date and correct, PFCU makes no representations or warranties of any kind, express or implied about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services or related graphics contained on the website for any purpose. Any reliance you place on such material is therefore strictly at your own risk.