Free Plus Interest Checking

Helping you spend, save and earn – all in one account.

- No minimum balance required ($500 minimum required to earn interest)

- No monthly maintenance fees

- Free Online Banking and mobile banking with mobile deposit3

- Free Visa Debit Card

- Overdraft protection option

- Free eStatement

- Free Bill Pay

- Early Direct Deposit – Get your funds up to two days early4

Visa Debit Card included

Your free Visa Debit Card comes with valuable benefits.

- Access to 120,000+ surcharge-free ATMs worldwide

- Mobile Wallet access

- Zero Liability Fraud Protection

Compare PFCU Checking Accounts

| Compare | Apex Checking | Free Plus Interest Checking | Refresh CheckinG3 |

|---|---|---|---|

| Monthly maintenance fee | $0 | $0 | $8.95 |

| Minimum opening balance | $25 | $0 | $25 |

| Minimum balance to earn interest | $01 | $5002 | n/a |

| Minimum savings amount | $5 | $5 | $5 |

| Free Online Banking and mobile banking | |||

| 120,000+ surcharge-free ATMs worldwide | |||

| Free Visa Debit Card | |||

| Overdraft protection | |||

| eAlerts |

Frequently Asked Questions

If you are already a member, you can open a new Checking and Savings account through Online Banking or the Mobile App, by going to More Services in the dashboard and then clicking Open a Share.

If you are not a member, head to our Become a Member page where you can learn more and fill out an application form.

For Apex Checking, there is a minimum opening deposit of $25 required, and no required balance to earn interest.

For Free Plus Interest Checking, there is no minimum opening deposit required, and $500 minimum balance required to earn interest.

For Refresh Checking, there is a minimum opening deposit of $25 required, and this account does not earn interest.

There is no minimum deposit that you must make into your checking account each month.

For more information on fees associated with our savings and checking accounts see our Fee Schedule.

You can re-order your checks online through our check partner Harland Clarke!

You can also contact us to make your first check order.

NOTE: Beginning June 2, 2025, the process for finding your account number will be slightly different, but for most of our members there will be no changes to your account number.

There are 3 ways you can find your account number:

1. Online Banking or Mobile Banking

- Log Into Online Banking or the Mobile Banking App.

- Select “More Services” from the main menu dashboard.

- Then select “Routing & Account Numbers.”

- To reveal your full account number, you may need to click the toggle above the account name.

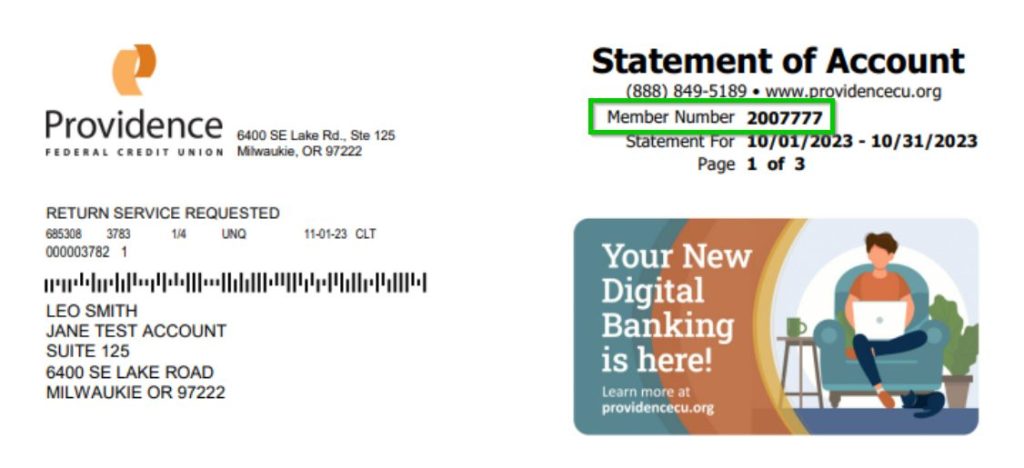

2. Bank statements (paper or electronic)

Your account number is listed as “Member Number” on the upper right of your monthly paper or eStatements.

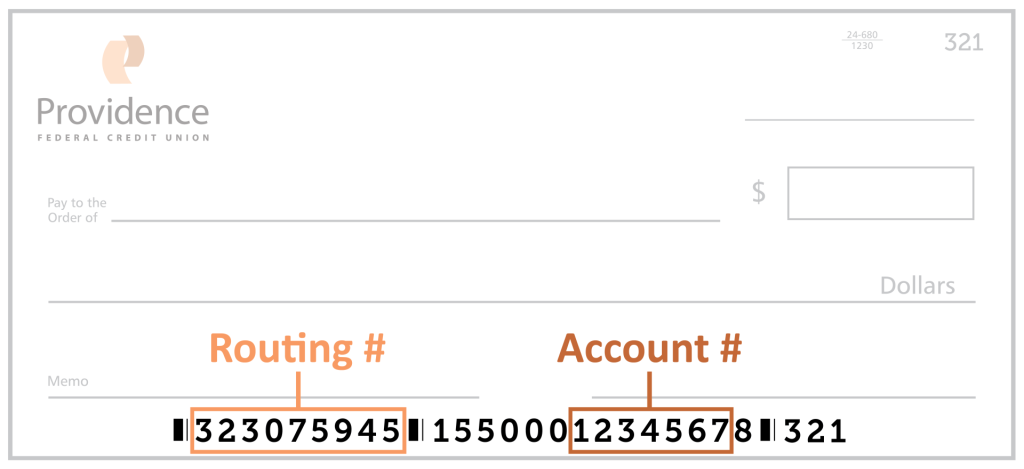

3. Checkbook

The middle section of the bottom row of numbers contains your account number. View the check image below for an example.

“

”

Need more information?

Connect with a PFCU Member Consultant, by scheduling an appointment, email, or phone.

*APY (ANNUAL PERCENTAGE YIELD). Dividends will be compounded and credited monthly. For dividend bearing accounts, the Dividend Period begins on the first calendar day of the period and ends on the last calendar day of the period. The Credit Union is federally insured by the National Credit Union Administration. Credit Union membership is required before utilizing any product and/or service by establishing a savings account with $5.00. Must be at least 13 years to open a checking account – see iProsper Teen Account.

1Minimum opening balance of $25.00. To receive the higher APY on balances up to $20,000 you must meet the monthly requirements. Apex Checking (High-Yield Checking), the account must be enrolled in eStatements, must have a payroll, social security, or pension direct deposit each month, at least one log-in to the CCCU online banking system each month and a minimum of 10 debit transactions each month (ATM transactions do not count toward the debit card requirements). The 10 debit transactions must be posted to the account prior to the last business day of each month regardless of when the transaction was conducted. All account requirements must be met by the last day of the month to qualify for the higher rate. The cycle for each month begins on the first day of each month. View current Savings Rates.

2A $500.00 average daily balance is required to earn monthly dividends. View current Savings Rates.

3This is a second-chance checking account. The monthly fee is $8.95 and requires direct deposit and eStatements. If there are no NSFs or Overdraft for 12 consecutive months since account opening, please contact the Credit Union to switch the account to the Free Plus Interest Checking Account. We’re cheering for you!

4You may receive a direct deposit up to two (2) days early with Early Direct Deposit or depending on when your employer/payer provides us the information, and if 1) you have a checking or savings account with us, and 2) a recurring qualifying direct deposit. It is at our discretion to identify which recurring direct deposits are eligible for Early Direct Deposit. We cannot guarantee that you will receive the Early Direct Deposit service due to unanticipated circumstances. Early Direct Deposit is automatic and it’s a free service.