Search PFCU

Providence Federal Credit Union offers great credit card options to fit every one of our member’s needs:

Once you have chosen your new credit card, complete our Online Application process.

Yes! To view your tax documents through Online Banking go to Statements in the dashboard (the dashboard is on the left side in Online Banking and at the bottom in the Mobile app).

Tax forms will be sent out each year at the beginning of February.

To make a wire transfer, download our Domestic Wire Transfer Request or International Wire Transfer Request form. Make sure you have the following information:

- Account holder name and full address

- Account number

- Branch number and full address

- Institution number

- Swift Code / BIC / IBAN code (international).

- Routing Number (domestic)

Related Information

Skip the checks and pay all your bills with Bill Pay

With PFCU Bill Pay, you can pay your monthly bills, schedule one-time or recurring payments, save money on buying stamps, and more. Plus, it’s faster than writing checks!

Visit our Bill Pay page to learn more or enroll today through Online Banking.

To order a new debit or credit card go to “Card” in Online Banking or your Mobile Banking App. From there you can order a new card by selecting “Lost Card” or “Damaged Card.”

Please review the Fee Schedule on our Rates Page for our current Card Replacement Fee.

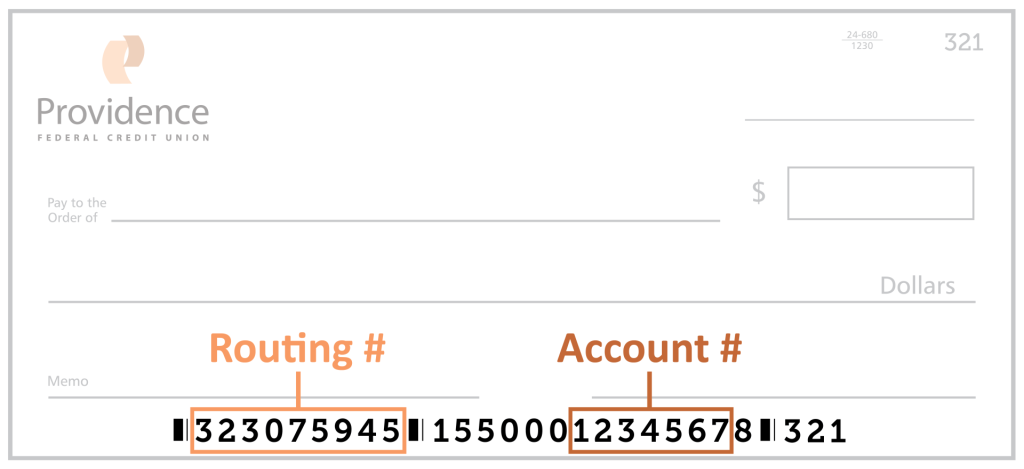

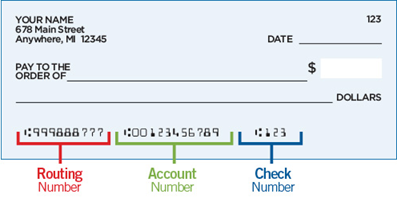

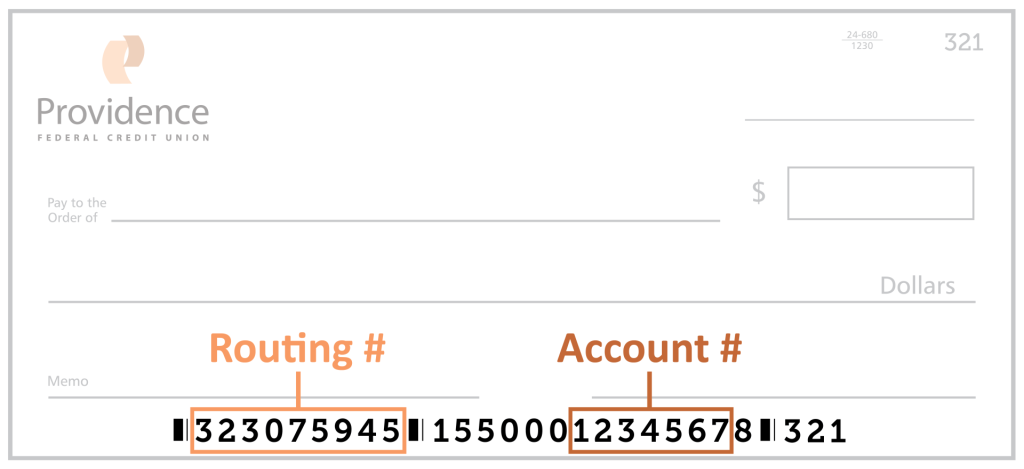

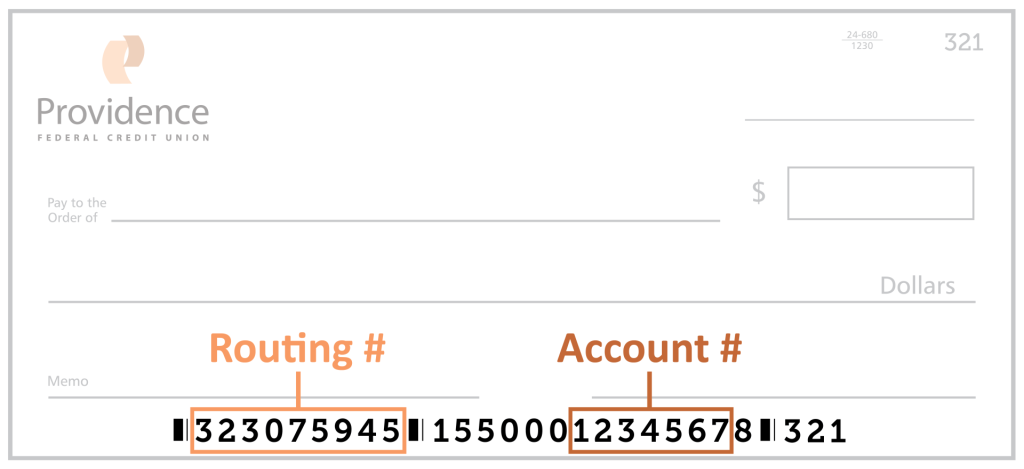

Providence Federal Credit Union’s routing number is 323075945, and can always be viewed at the bottom of our website, or the bottom left of your checks.

This information, along with Account Numbers, can be found in Online Banking by going to More Services and then Account and Routing Numbers.

You may be wondering, what is a routing number anyway? Good question. A routing number is a 9-digit code used to identify financial institutions in electronic transactions.

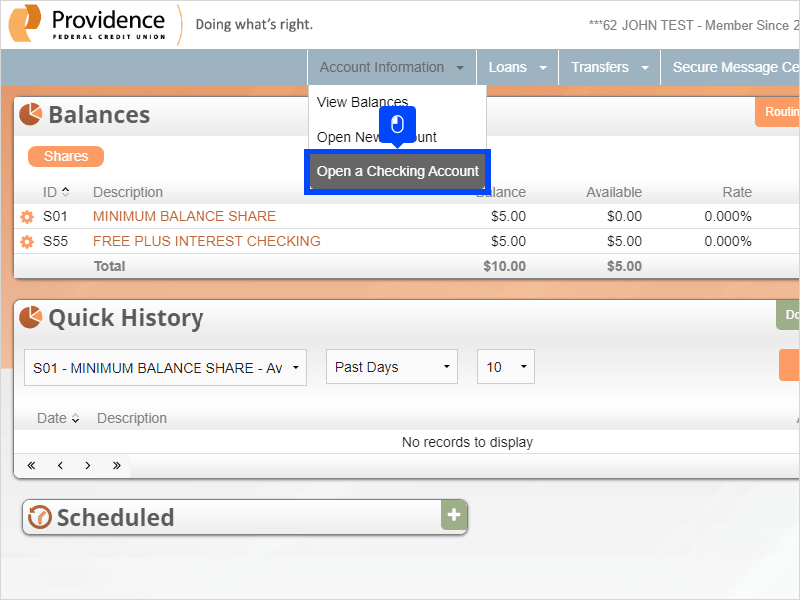

If you are already a member, you can open a new Checking and Savings account through Online Banking or the Mobile App, by going to More Services in the dashboard and then clicking Open a Share.

If you are not a member, head to our Become a Member page where you can learn more and fill out an application form.

To make a wire transfer, download our Domestic Wire Transfer Request or International Wire Transfer Request form. Make sure you have the following information:

- Account holder name and full address

- Account number

- Branch number and full address

- Institution number

- Swift Code / BIC / IBAN code (international).

- Routing Number (domestic)

Related Information

Skip the checks and pay all your bills with Bill Pay

With PFCU Bill Pay, you can pay your monthly bills, schedule one-time or recurring payments, save money on buying stamps, and more. Plus, it’s faster than writing checks!

Visit our Bill Pay page to learn more or enroll today through Online Banking.

Yes, we do offer consolidation loans! With a consolidation loan, you can reduce your monthly payment, total interest paid, or both. Visit our Financial Wellness page for more information.

To calculate the cost of refinancing your first mortgage use one of our Financial Calculators or speak with one of our representatives for assistance.

The specific amount of your closing costs varies by situation. Appraisal fees, title charges, and closing fees may all vary from state to state and from lender to lender. To evaluate your closing fees, we’ve created three categories of which you should remain aware:

- Third-party fees

- Taxes and other unavoidable costs

- Lender fees

| Third-Party Fees | Taxes and Other Unavoidable Costs | Lender Fees |

We collect any third-party fees and pass them on to the person who actually performed the service. |

These fees will most likely have to be paid regardless of the lender you choose. If some lenders don’t quote you fees that include taxes and other unavoidable fees, don’t assume that you won’t have to pay it. It probably means that the lender hasn’t done the research necessary to provide accurate closing costs. |

These fees are retained by the lender and are used to provide you with the lowest rates possible. This is the category of fees that you should compare very closely from lender to lender before deciding. Please note, this may not be an exhaustive list. |

Yes, you can skip up to 30 days of payments, allowing you to free up money for unexpected expenses. There is a $30 fee per loan that you skip and by skipping your payment, you will extend the term of your loan. Fill out our Skip-A-Pay Coupon Form to get started.

Adding an external account is easy through Online Banking or our Mobile Banking App. Simply go to Move Money in the online banking dashboard. Then select Manage Destinations, and then Add External Account. Connect your account through the Plaid portal by following their on-screen prompts. Plaid will likely need to initiate a withdrawal and then deposit of a $0.01 micro transaction to connect the accounts.

After the process is complete this account will be an available option when selecting where to transfer funds in the Payments & Transfer section of Move Money.

Yes! We strive to provide the financial assistance you need despite less than perfect credit history.

For more information, please visit our Auto Loans page or apply today!

Yes. You will be subject to closing costs if your Home Equity Line application is approved.

For specifics, please visit a branch or contact us.

At this time, we do not offer Zelle.

Related Information

Access your accounts anytime with Mobile Banking

Our mobile app does everything you’d expect from a banking app, like make deposits and manage accounts. Type Providence FCU into your phone’s App Store or Google Play store and log in with your Online Banking username and password.

Learn more about the convenient features of Mobile Banking.

For our branch locations and hours, visit our Branch Locations page. To reach a Member Service Representative, refer to our Contact Us page.

Hope to see you soon!

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

If you have a higher credit score, lenders and investors will be more likely to provide lower interest rates and fees. If your credit history is good, investors will have more confidence in your ability to pay on time consistently.

Did you know you can check your own credit score for free once annually? A good credit score is essential to your financial health. Visit annualcreditreport.com to receive a free copy of your credit score.

For Apex Checking, there is a minimum opening deposit of $25 required, and no required balance to earn interest.

For Free Plus Interest Checking, there is no minimum opening deposit required, and $500 minimum balance required to earn interest.

For Refresh Checking, there is a minimum opening deposit of $25 required, and this account does not earn interest.

Yes! You can deposit funds at a PFCU ATM! Deposits can be made in either cash, or by check.

If you are making a large deposit by check it may take more than one business day for the funds to become available. Click here to find an ATM location near you!

View our current Auto Loan rates on the Rates page of our website.

For more information, please visit our Auto Loans page or apply today!

Update contact information in Online Banking or the Mobile Banking app

When logged in to Online Banking, click on the circle with your initials in the upper right corner. From the dropdown, click on “Settings.” From the “Personal Information” tab you can update your email, phone number, and address. Simply click on the pencil icon for the corresponding section you would like to update. Remember to also click the check mark icon when you are ready to save your changes.

Account Change Form

If you need to update your name, or other settings that aren’t found in online banking (like beneficiaries or joint account holders) please fill out the Account Change Form via DocuSign. You will need to upload images of a valid government issued ID. This form can also be completed in person, just be sure to bring your valid government issued ID with you.

Your employer is responsible for establishing direct deposit on your behalf. You will typically fill out a basic form requesting the following information, and they’ll do the rest.

- Credit union routing number (323075945)

- Your checking account number

- A voided check to verify the routing & checking numbers

- The address of your financial institution:

- Providence Federal Credit Union

6400 SE Lake Road, Suite 125

Milwaukie, OR 97222

- Providence Federal Credit Union

Access Direct Deposit Forms from our Disclosures & Forms page and review our Funds Availability Policy for information on when your deposits will be available.

Related Information

Now you can make check deposits from your phone!

All it takes is a few taps and the click of your camera; simple as that. Our Mobile Deposit service is fast, secure, and best of all – free!

For more information and to get started today, visit our Mobile Deposit page.

Find a convenient Providence Federal Credit Union branch or surcharge-free ATM near you on our Contact and ATM Locations pages today!

Attention all Providence FCU members: you can now access nearly 90,000 ATMs across the country for free!

Now you can get surcharge-free cash at more ATMs than ever! Visit any ATM that displays an Allpoint, CO-OP, or MoneyPass logo:

Find a surcharge-free ATM right now with our ATM Locator Tool!

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

To request a credit limit increase please fill out a new credit card application, and a loan officer will work to increase the limit on your existing card.

Mortgage rates are determined by the Wall Street Prime rates. When the economic outlook is good, rates tend to increase, and rates fall when it’s not so great. It seems somewhat backward, but here’s the reasoning: When the economy is doing well, borrowers can afford more. This affects the market for mortgages, which results in slightly rising rates. Conversely, when the economy declines and unemployment rates increase, interest rates fall to make it more affordable for borrowers to take out loans.

For our most current mortgage rates, visit our Rates page.

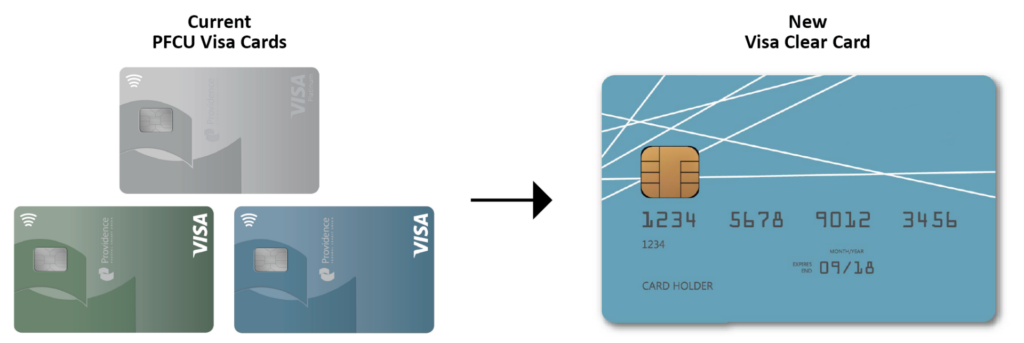

No, we do not offer a credit card rewards program, but we do have several credit cards options:

- Visa Platinum

- Visa Classic

- Visa New Beginning

Our credit cards have great features that make being a member at Providence Federal Credit Union worthwhile!

- No annual fee and cash advance fees

- Internet Authentication Service (Verified by Visa®)

- Fraud protection – provides 24/7 fraud monitoring

- $500,000 Travel and Accident Insurance

- Emergency Cash and Card Replacement

- Zero Liability

- Free balance transfers up to your credit limit

- Visa Global Customer Assistance Services (GCAS)

There is no minimum deposit that you must make into your checking account each month.

For more information on fees associated with our savings and checking accounts see our Fee Schedule.

The maximum daily withdrawal from an ATM is:

- Platinum: $500.00/day

- Gold: $350.00/day

- Silver: $300.00/day

For withdrawals surpassing the limit, please visit your local branch.

Find a surcharge-free ATM right now with our ATM Locator Tool.

We’re always trying to get you the best possible deposit rate, and therefore rates are subject to frequent change. Please find current certificate rates on our Rates page.

- $1,000 minimum to open

- Dividend paid monthly

- Variety of terms (6 to 24 months) and rates

- Automatically renews upon maturity

- Penalty for early withdrawal

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

You can transfer money from one account to another account using Online or Mobile Banking. Log in to your account and click the Transfers option to get started.

With Online Banking you also get all these great, free, features:

- Pay bills, transfer money, apply for a loan, and check balances any time of day.

- Check account balances, view histories, transfer funds

- View and print cleared check images

- Download account information into Quicken

Related Information

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Once you’re signed up for Online Banking, use your username and password to go mobile!

Choose an icon below to get started right now!

Learn more about the convenient features of Mobile Banking.

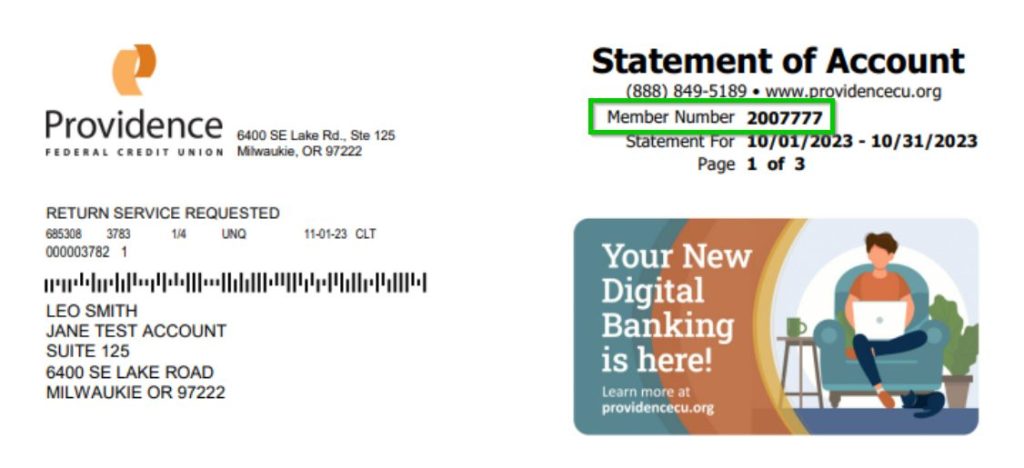

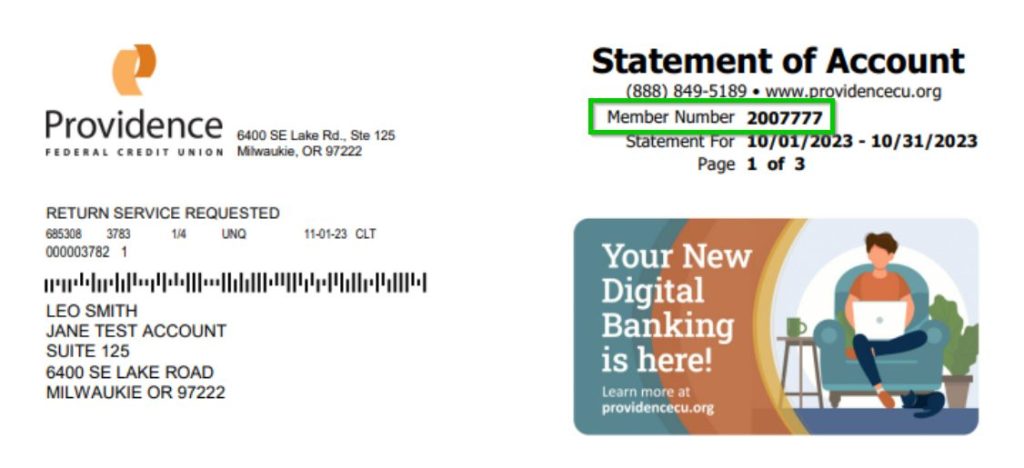

If you are enrolled in eStatements, you will receive an email when your statement or notice is available. If you are not enrolled in eStatements, you will receive your statement in the mail at the address you provided when signing up with Providence Federal Credit Union.

To view your statements, or enroll in eStatements go to the Statements tab in the online banking dashboard, or mobile banking app.

Within Online Banking, you can view and print statements for up to 18 months. If you would like a copy of a statement prior to this timeframe, contact a Member Service Representative at [email protected].

We’re always trying to get you the best possible deposit rate, and therefore rates are subject to frequent change. Please find current savings rates on our Rates page.

Providence Federal Credit Union offers a variety of savings account to fit all of our members’ needs. Explore our options on our Savings Account page.

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

You can search for all our locations from our ATM Locator tool!

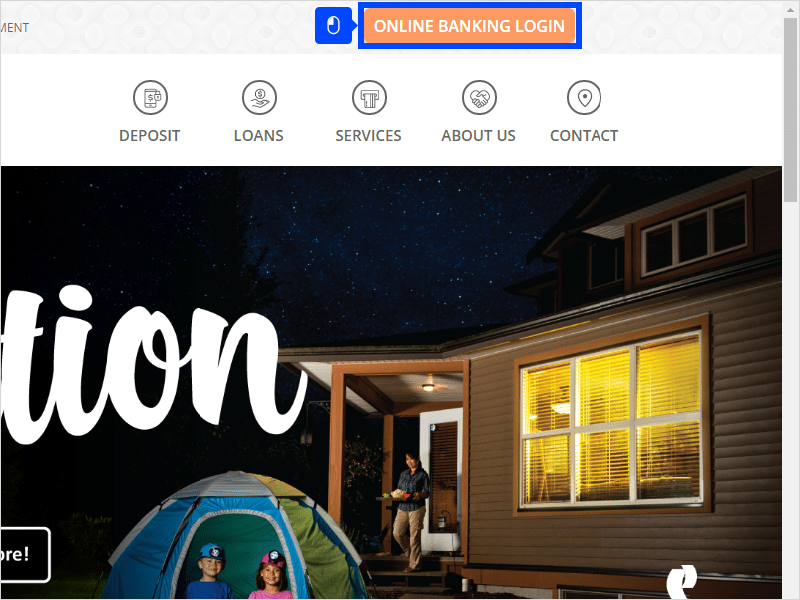

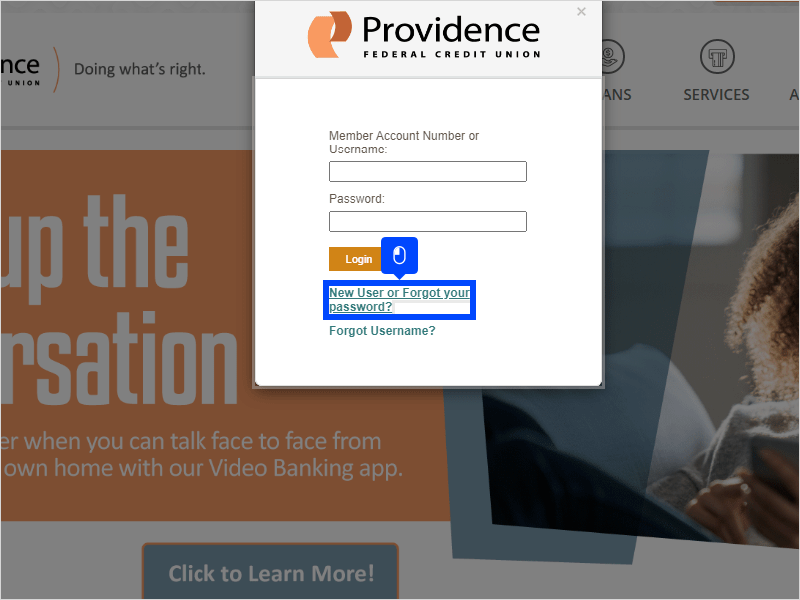

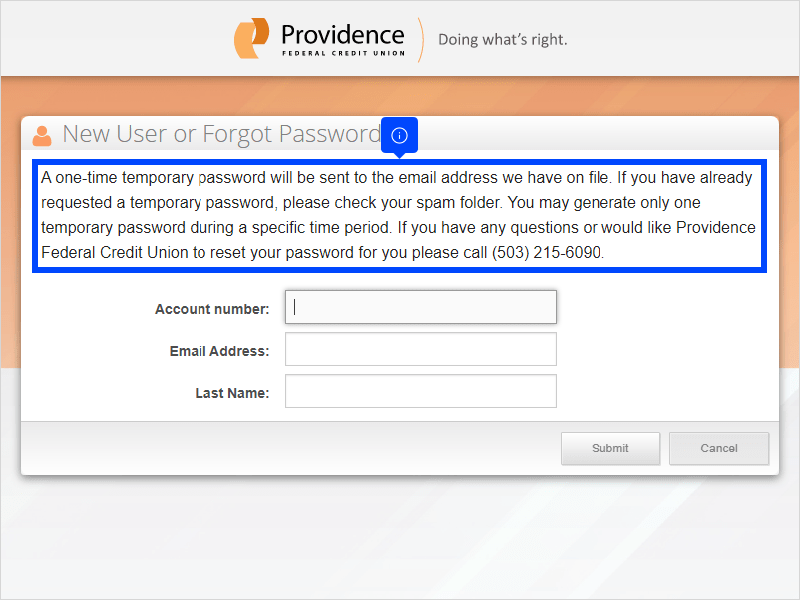

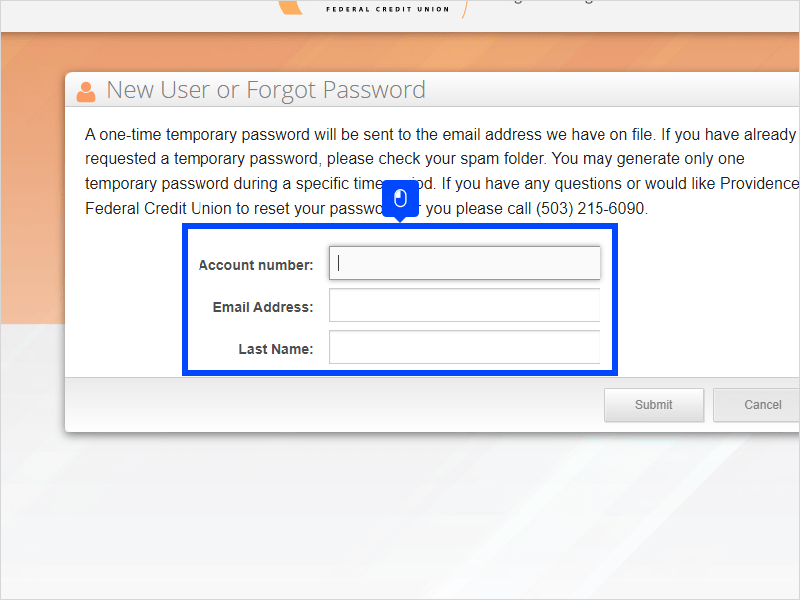

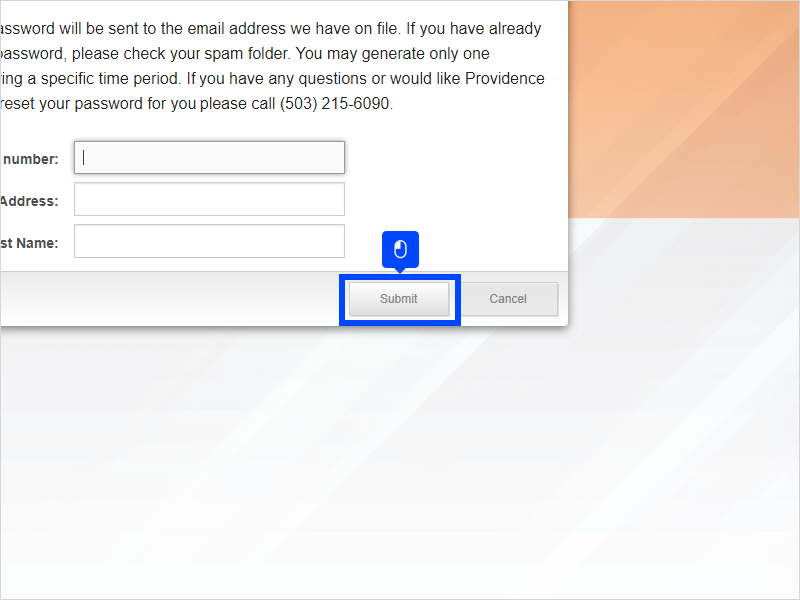

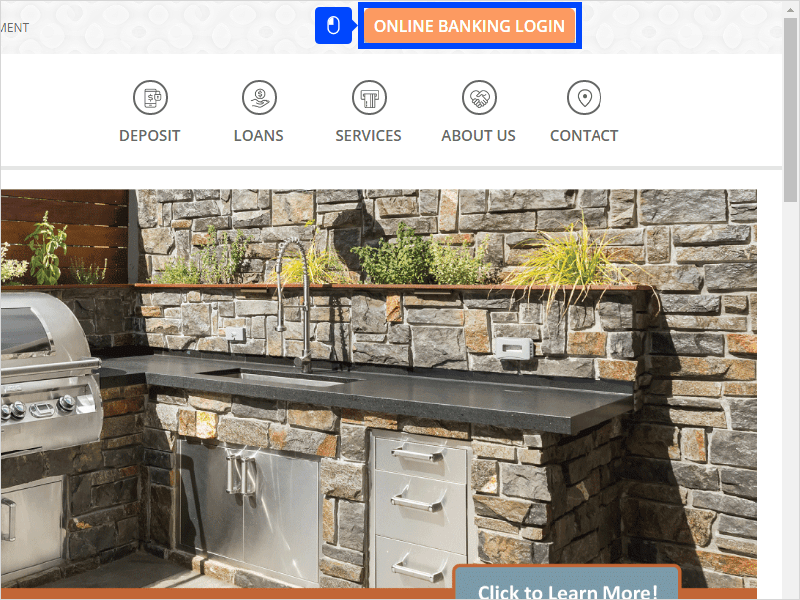

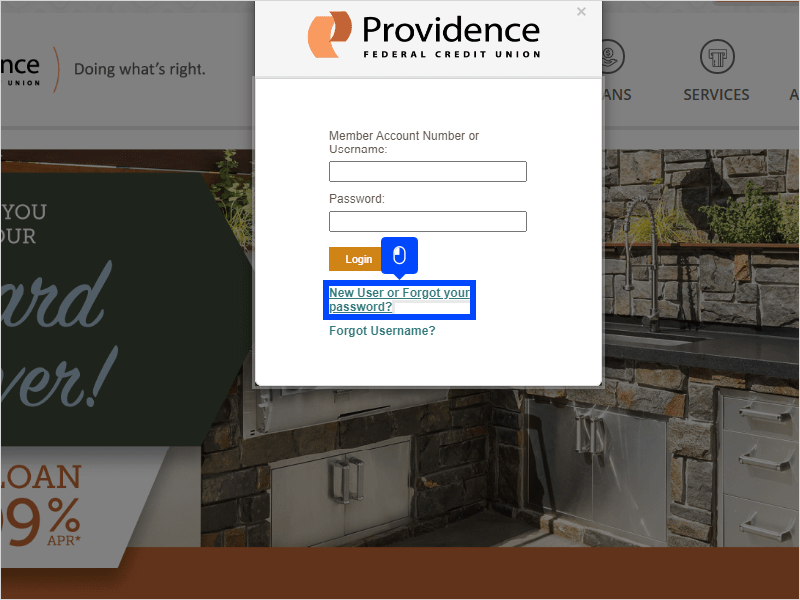

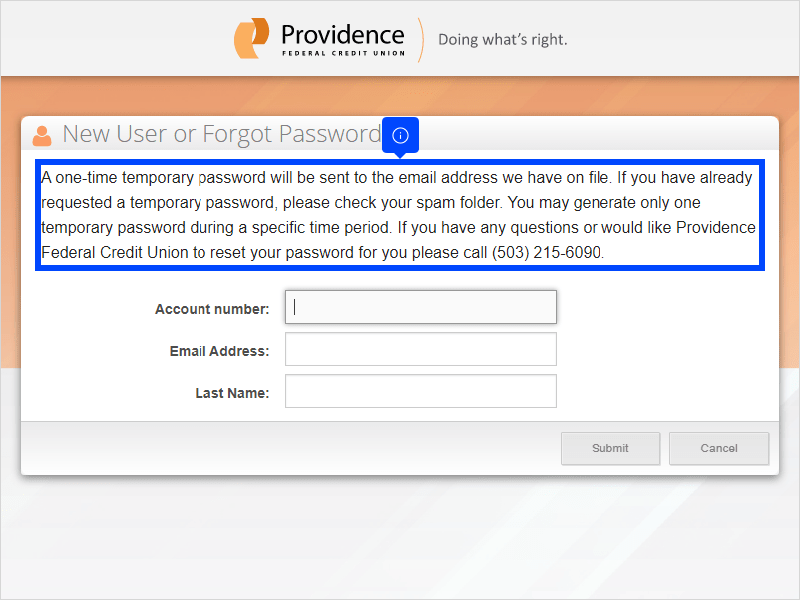

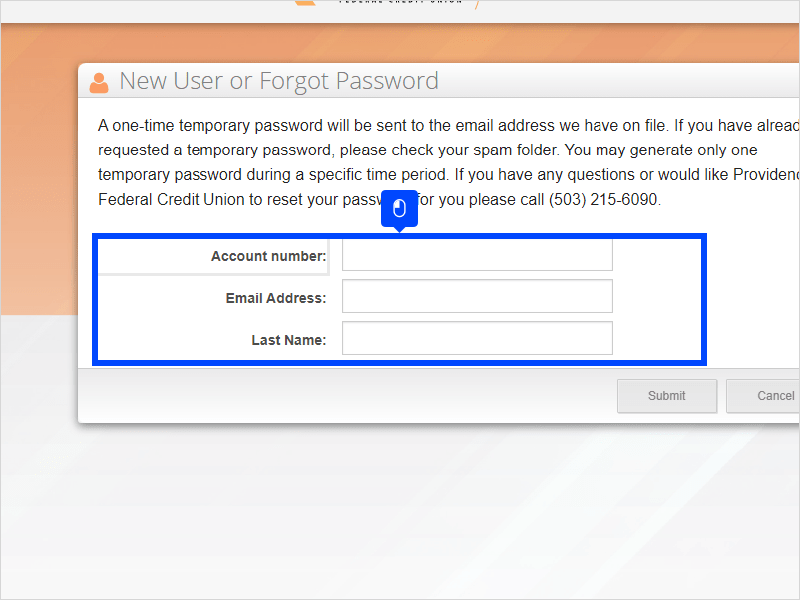

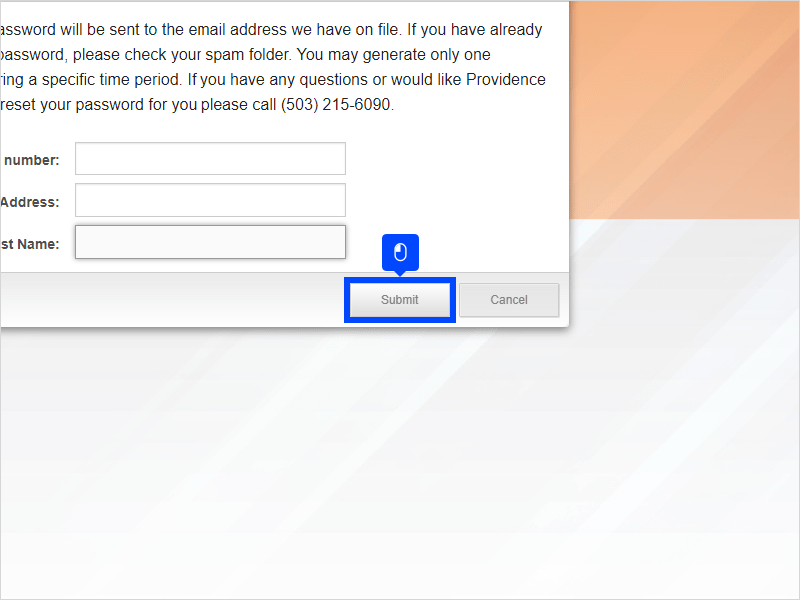

Follow the steps in the tutorial below to register for Online Banking:

5 STEPS

1. From our website home page, click Online Banking Login

2. Click New User or Forgot your password?

3. Read the information about your temporary password.

4. Enter your Account Number, Email Address, and Last Name.

5. Click Submit and you’re done!

Here’s an interactive tutorial

https://www.iorad.com/player/1675315/How-do-I-register-for-Online-Banking-

With Providence Federal Credit Union Online Banking you can:

- Pay bills, transfer money, apply for a loan, and check balances any time of day.

- Check account balances, view histories, transfer funds

- View and print cleared check images

- Download account information into Quicken

Related Information

Don’t have Providence FCU Mobile?

Get started with Mobile Banking! It’s super easy. Type Providence FCU into your phone’s App Store or Google Play store and log in with your Online Banking username and password.

Already on your phone? Choose an icon below to get started right now!

Learn more about the convenient features of Mobile Banking.

To change your Online Banking password, follow the tutorial below:

5 STEPS

1. From our website home page, click Online Banking Login

2. Click New User or Forgot you password?

3. Read the temporary password instructions.

4. Fill in the fields

5. Click Submit. Find the email in your inbox, follow the instructions, and that’s it! You’re done.

Here’s an interactive tutorial

https://www.iorad.com/player/1675361/How-do-I-change-my-Online-Banking-password-

Related Information

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

You can re-order your checks online through our check partner Harland Clarke!

You can also contact us to make your first check order.

If you have been locked out of Online Banking, you may have exhausted your login attempts.

To unlock your account contact us or email [email protected].

To add a joint owner to your account, visit the Disclosures & Forms page and click on the Account Change Form. You’ll need ID for each applicant.

We send out tax forms annually at the beginning of February. You will receive your tax forms by mail and you will also be able to access then in Online Banking.

Related Information

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

There is no fee for mobile deposit! Mobile Deposit is a completely free service offered through Online Banking.

For more information on mobile deposit visit the Mobile Deposit page of our website.

If you or your family are a UDW member, staff, or retiree member you may be eligible to join PFCU.

We will do everything we can to have you join PFCU. We want to ensure more care workers have access to affordable interest loans, higher savings yields, lower fees, and financial advice. Everyone’s case is unique. We want to hear your story and find all the ways to say “YES”. We’ll work to help you take control of your finances by providing only the best products and services.

Please see our Rates Page for information on our current loan and credit card rates. Review our Fee Schedule for information on ATM, service, and account fees.

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

If you are traveling abroad or within the US, you can let us know through Online Banking or the PFCU Mobile Banking app. Simply go to Cards in the dashboard and then select Travel.

Be ready with the following information:

- Where you are traveling to

- How long you will be traveling

For more information on the benefits of using our PFCU Credit Cards, visit our Visa Card page.

At Providence Federal Credit Union we offer a variety of different term options with great rates of return:

- 6 Month Certificate

- 12 Month Certificate

- 18 Month Certificate

- 24 Month Certificate

For more information, visit our Certificates Page.

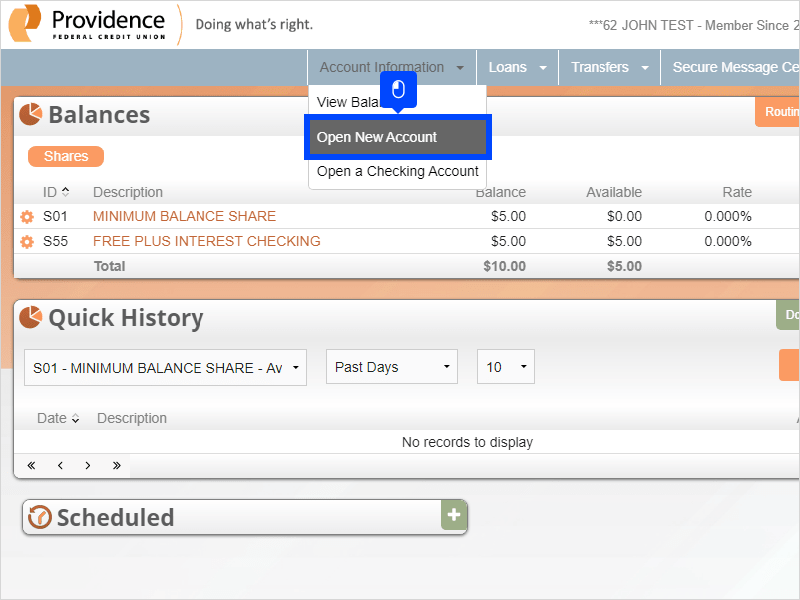

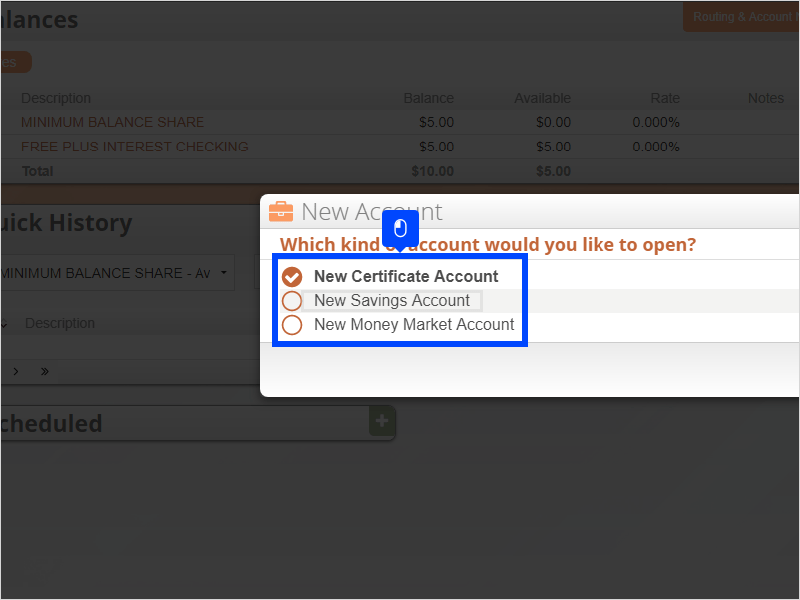

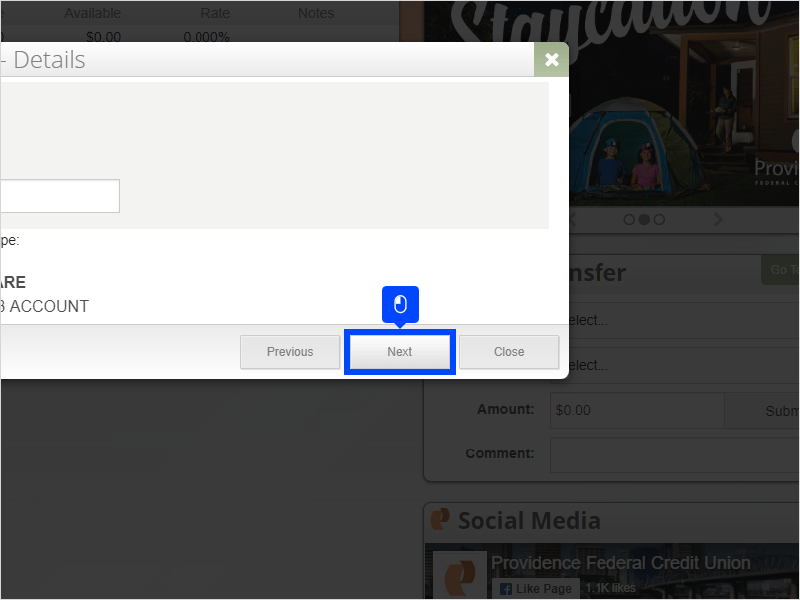

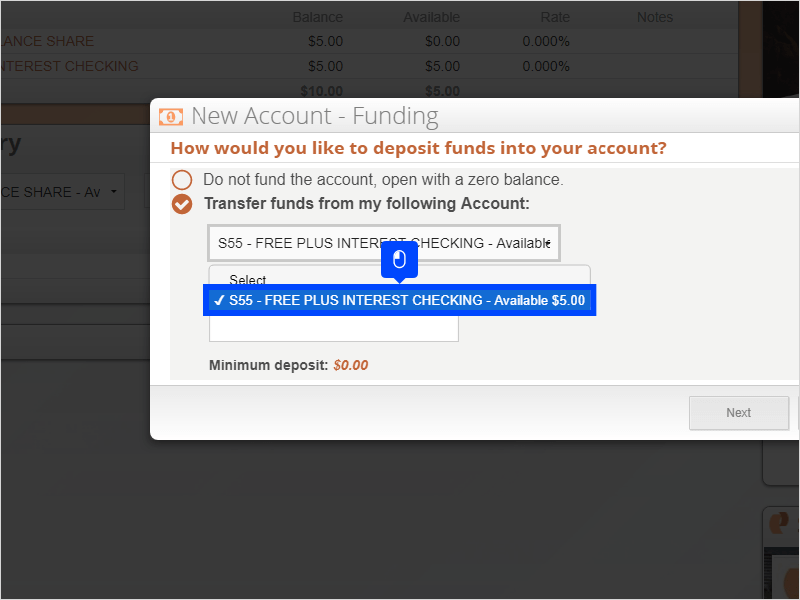

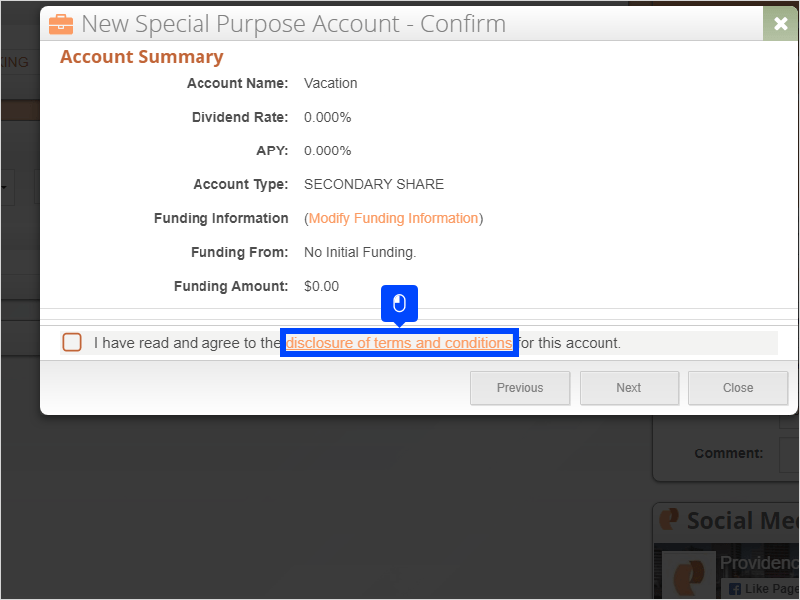

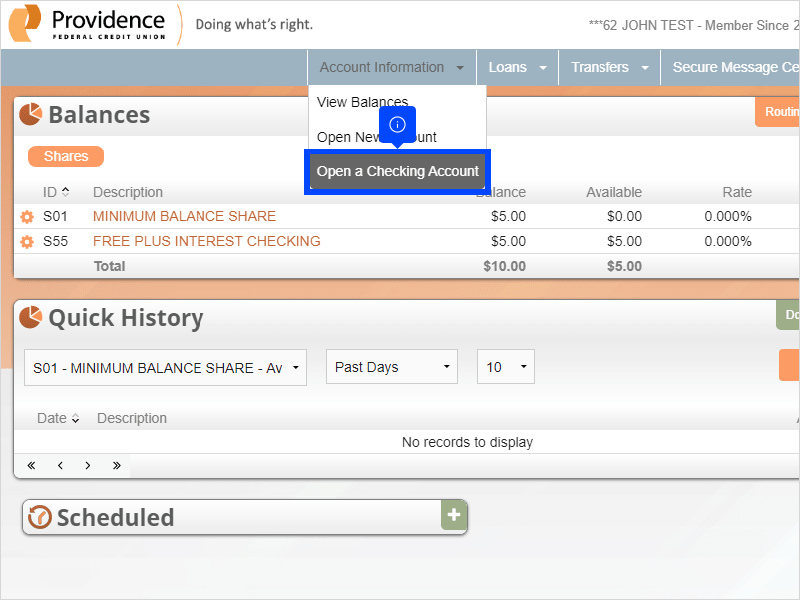

Follow the tutorial below to open a new account through Online Banking:

18 STEPS

1. If you would like to open a Savings Account, log in to Online Banking and and click Open New Account

2. Select the account type you want to open

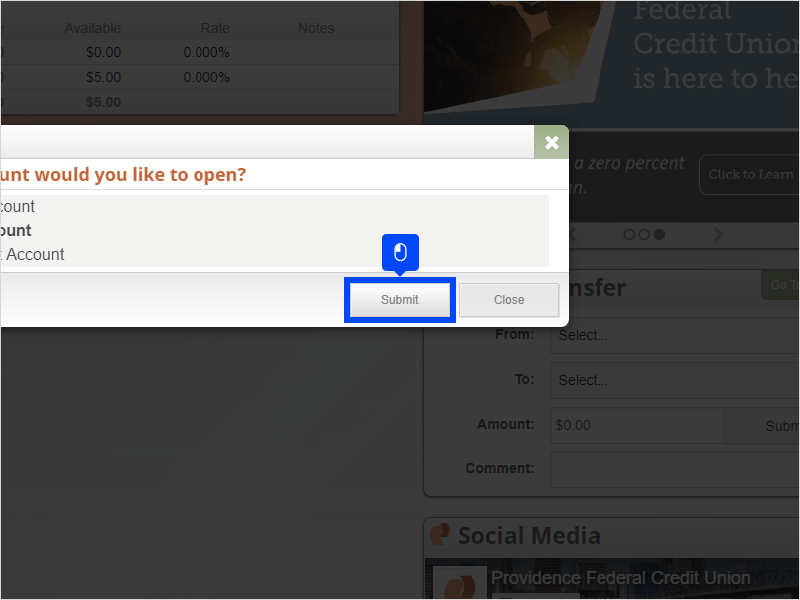

3. Click Submit

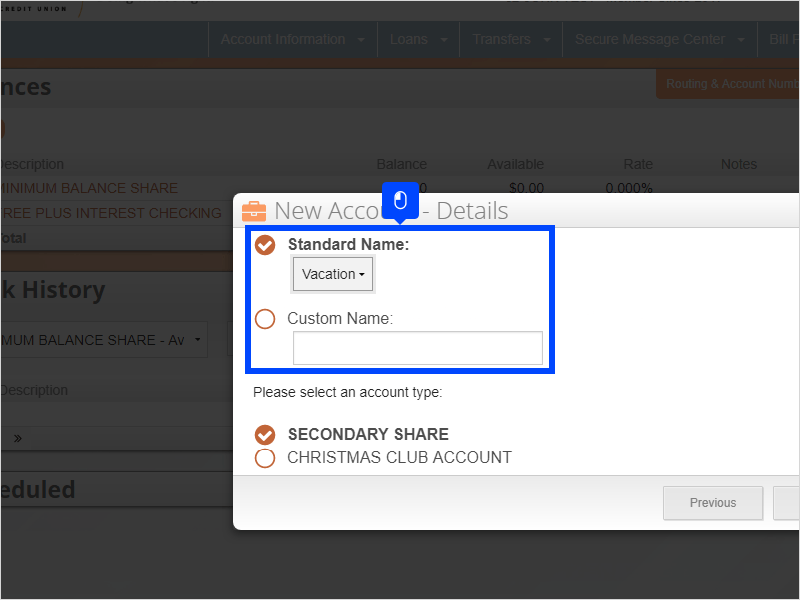

4. Choose the name you would like your account to have or type a custom name

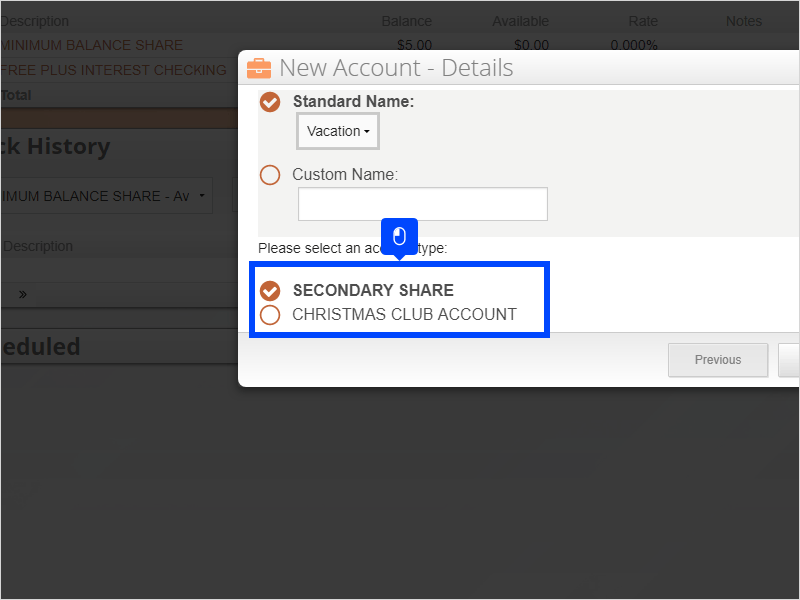

5. Select the account type you would like to open

6. Click Next

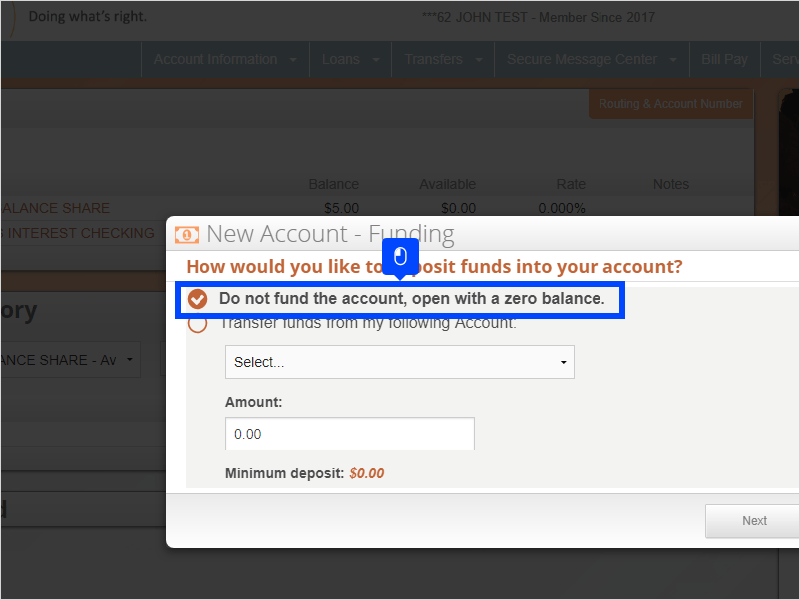

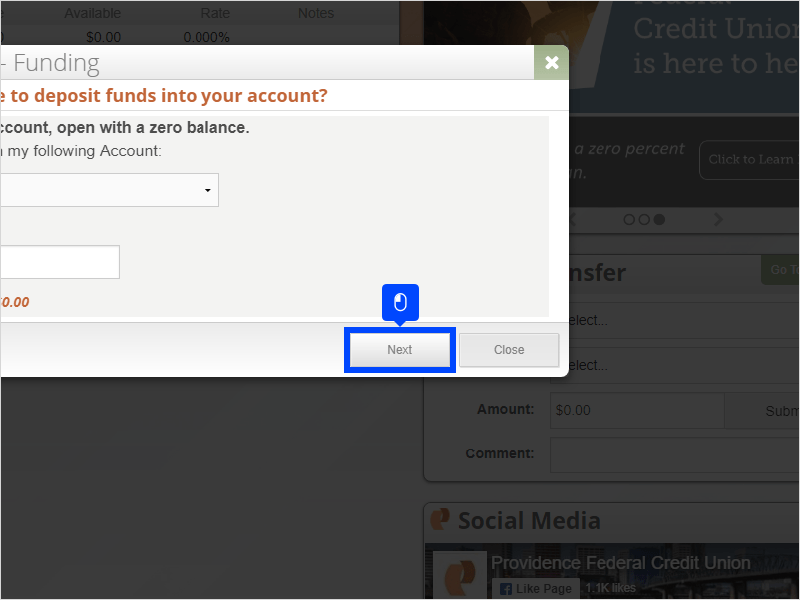

7. If you would like to start your new account with a $0.00 balance, choose Do not fund the account

8. Click Next

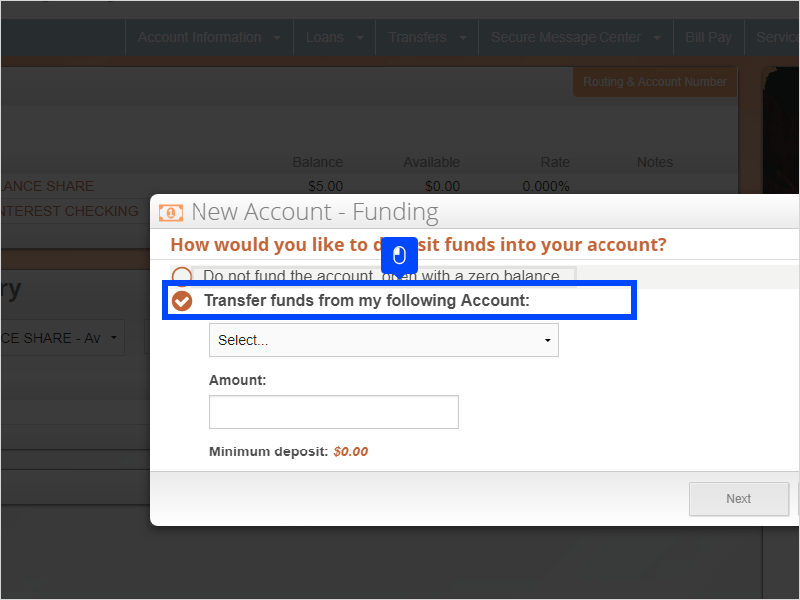

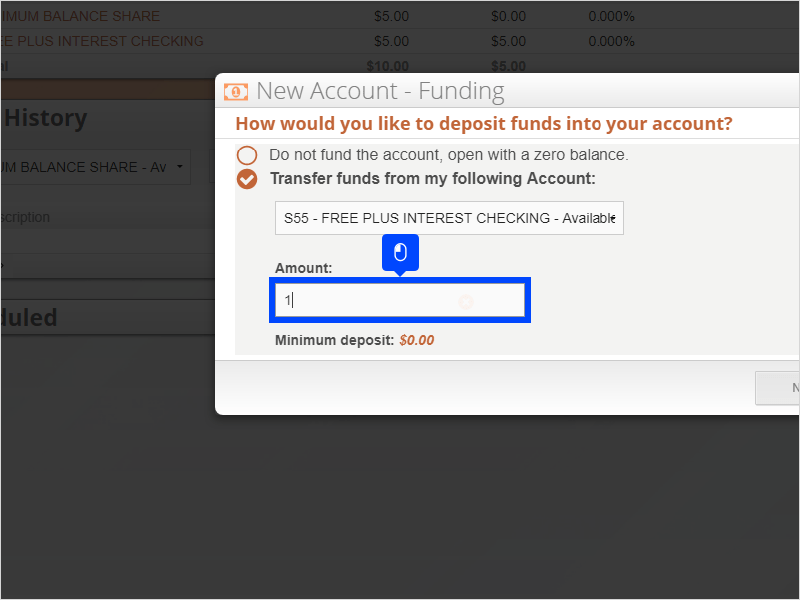

9. If you would like to start your new account with an initial deposit from your existing Providence account, select the Transfer Funds option

10. Select the existing account you would like to use to fund your new account

11. Type in the Amount you would like to place in the new account

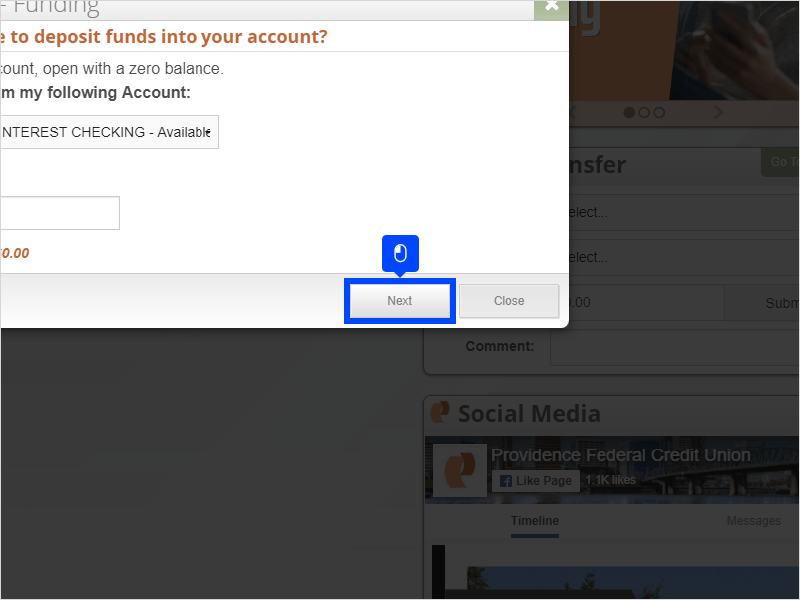

12. Click Next

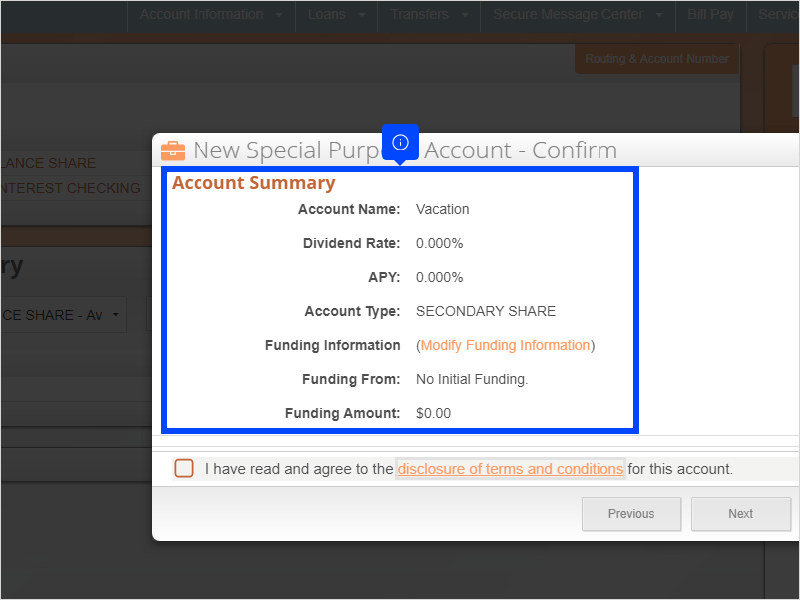

13. Review the Account Summary to confirm all of the details are correct

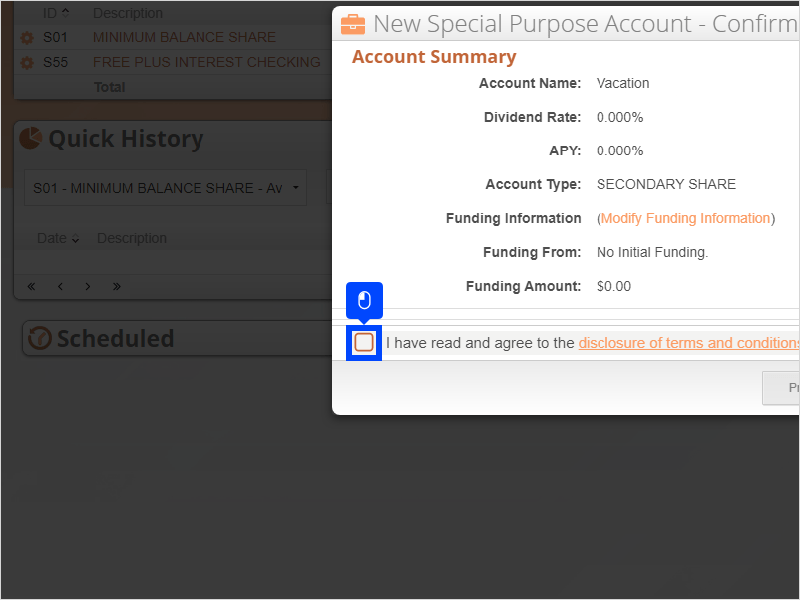

14. Read the Disclosure of Terms and Conditions

15. Check off the I Have Read and Agree box

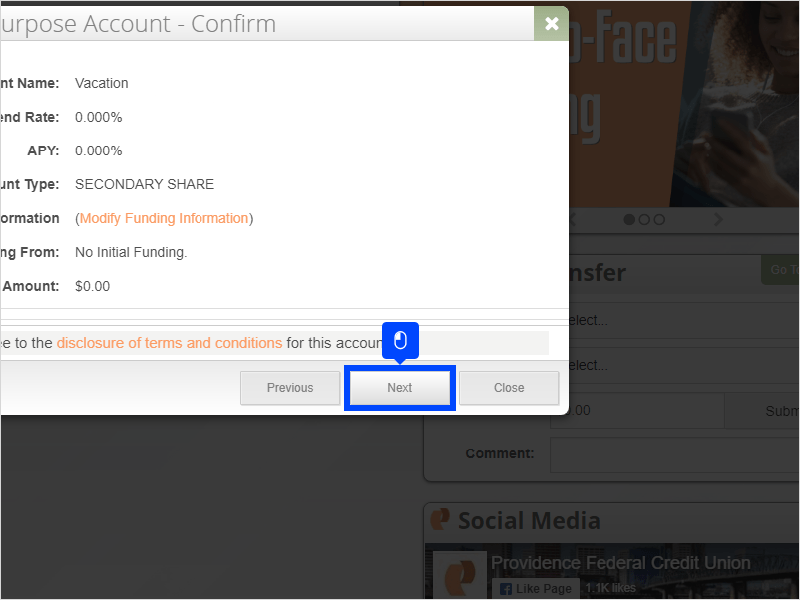

16. Click Next

17. To open a Checking Account, click Open a Checking Account

18. A fillable PDF form will open in a new window. You will need to fill out the form and follow the directions within the PDF to submit the application.

And that’s it. You’re done.

Here’s an interactive tutorial

https://www.iorad.com/player/1676589/How-do-I-open-a-new-account-through-Online-Banking-

Any Providence Federal Credit Union accounts can be viewed within Online Banking.

Related Information

Access your new account from your phone!

Get started with Mobile Banking! It’s super easy. Type Providence FCU into your phone’s App Store or Google Play store and log in with your Online Banking username and password.

Already on your phone? Choose an icon below to get started right now!

Learn more about the convenient features of Mobile Banking.

You may also need:

Providence Federal Credit Union is no longer participate in the Shared Branch Network. Providence FCU will continue to maintain membership in the surcharge-free ATM Network which allows surcharge-free withdrawals and deposits (where accepted) at 90,000 locations nationwide.

Use our ATM Locator tool to find a surcharge-free ATM near you.

Please use the following mailing address:

Providence Federal Credit Union

6400 SE Lake Road, Suite 125

Milwaukie, OR 97222

Find any of our convenient locations on our Branch Locations page or Contact Us today!

Related Information

Enroll in free Online Bill Pay where it’s as simple as click, click, pay!

With PFCU Bill Pay, you can pay your monthly bills, schedule one-time or recurring payments, save money on buying stamps, and more! Plus, it’s faster than writing checks!

Ready to get started? Enroll today through Online Banking.

You can refinance your auto loan using our Online Application.

In order to enroll in eStatements you must first be enrolled in Online Banking. When enrolling you will be asked if you want to opt-in to eStatements.

If you are already enrolled in Online Banking and would like to switch to eStatements you can do so by clicking on Statements inside Online Banking. From there you can select Manage Preferences and then toggle Enable All to go paperless and begin receiving your monthly statements via email.

If your card has been lost or stolen we recommend that you block your card in Online Banking or the Mobile Banking app immediately. To do this, log in to Online Banking or your Mobile Banking app, go to “Cards” and then “Lock Card.” You can then go to “Lost Card” to order a replacement card. You can also contact us at (866) 633-7032. We will block and reissue your card.

Please review our Deposit Fee Schedule on our Rates page for our current Card Replacement Fee.

To learn more on how you can protect yourself, please visit our Security page. If you suspect your accounts have been compromised, Contact Us right away!

If you would like to close your account please fill out our Account Closure Form, and submit it to our member service representatives.

We work hard to earn the honor of being your trusted financial partner. As your financial cooperative, we think it’s important for you to know the value your Providence FCU membership offers. We’ve always believed that we offer you a better overall value than banks.

Loan qualifications differ depending on which loan you are applying for. The best way to find out if you qualify for a loan is to apply!

Your credit score plays a role in whether or not you qualify for a loan. You can check your own credit score for free once annually by visiting www.annualcreditreport.com.

Apply for a loan today!

Applying for a loan is quick and easy at Providence Federal Credit Union. Simply fill out the application, select the loan product you’re interested in and we’ll take care of the rest.

Yes, we do. Providence Federal Credit Union is here to help with our Holiday Club Account. Simply stash away a little bit of cash every month and you’ll be a Santa rock star come December. Imagine stress-free holidays and your loved ones getting everything on their wish lists!

For more information, visit our Savings Page and see our current savings account rates on our Rates Page.

Visit our Contact Us page to reach us! If you would like to schedule a one-on-one appointment with one of our skilled Member Service Representatives, click here.

Let’s get in touch!

Related Information

Need access to your PFCU account information?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

To add a joint owner to your account, visit the Disclosures & Forms page and click on the Account Change Form. Once you have filled out the form, email it to [email protected].

Related Information

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Our current wire transfer fees are listed on our Fee Schedule. To make a wire transfer stop into any of our branch locations.

Please see our Wire Transfer Page for more information.

Related Information

Skip the checks and pay all your bills with Bill Pay

With PFCU Bill Pay, you can pay your monthly bills, schedule one-time or recurring payments, save money on buying stamps, and more. Plus, it’s faster than writing checks!

Visit our Bill Pay page to learn more or enroll today through Online Banking.

For our most up to date overdraft fee please refer to our Fee Schedule. Overdraft fees are charged to your account when you spend more money than you have in your available balance.

Take steps toward your financial wellness with PFCU!

At Providence Federal Credit Union, we believe empowering members with the tools and resources to make smart financial decisions is a critical component to living a healthier financial life. With their years of experience in the financial industry, our Financial Coaches are here to provide a customized experience for you that will support your financial goals.

Schedule a one-on-one financial coaching session with one of our certified financial counselors.

If you or a family member work for Providence Health or any of its subsidiaries, you may be eligible to join. Members and staff of partner associations are also eligible. Once you’re a member, your family member (i.e. husband, father, aunts, uncles, cousins, in-laws, domestic partner, and grandparents) can join. And you can stay as long as you like – even if you leave the Providence, UDW, EyeHealth Northwest, or The Portland Clinic, LLP network.

You are eligible if you fit into one of the criteria below:

- Every Providence employee, intern, contractor, retiree, and family member

- Every UDW member, employee, retiree, and family member

- EyeHealth Northwest

- The Portland Clinic, LLP

Ready to become a PFCU family member?

Unfortunately, Providence Federal Credit Union does not offer construction loans at this time. However, we do offer a variety of Mortgages if you are looking to purchase an existing home!

Related Information

Looking to buy or renovate your home? We want to get you there!

Whether you’re in the market for a new pad or looking to remodel your current house, we have the perfect loan to fit your needs. Let us customize a financial solution that’s just right for you and help you make the best decision for you and your home.

For more information, please visit our Mortgage page or apply today!

You must make a deposit to correct the negative balance. Stop by one of our branches or use our Mobile Deposit service to address the issue.

If you have any questions pertaining to the balance on the account, please contact us.

Now you can make check deposits from your phone!

All it takes is a few taps and the click of your camera; simple as that. Our Mobile Deposit service is fast, secure, and best of all – free!

For more information and to get started today, visit our Mobile Deposit page.

To add an account within Online Banking, follow the steps below:

- Log in to your Online Banking account.

- Select the More Services tab in the dashboard.

- Click on Open a Share to open our account application portal.

- Select the type of account you’d like to open and fill out other necessary information before submitting.

Please follow the steps below to place a stop payment through Online Banking, or the PFCU Mobile Banking App:

- Log in to your Online Banking account

- Click on the More Services tab in the online banking dashboard.

- Click on the Stop Payments then New Stop Payment.

- Enter the necessary information, like the Check Number, and when completed click Submit.

Our current cashier’s check fee is listed in our Fee Schedule.

A cashier’s check (or cashier’s cheque) is a check guaranteed by a bank, drawn on the bank’s own funds and signed by a cashier. Cashier’s checks are treated as guaranteed funds because the bank, rather than the purchaser, are responsible for paying the amount.

Related Information

Visa benefits just for you from PFCU!

If your credit card company has increased your rates, bumped up your minimum payments, or hiked up their late fees, then check out our Visa Programs. You’ll find low rates, low or absolutely no fees, and easy access to your money.

For more information, please visit our Credit Cards page or apply today!

No, there is no fee. Early Direct Deposit is free for all members as a benefit of having a checking or savings account with us.

Our members can visit any of nearly 90,000 ATMs that display the Allpoint, CO-OP or MoneyPass logo.

To learn more or find an ATM near you, check out our ATM Locator.

You can determine your loan payoff amount in Online Banking or your Mobile Banking App. When logged in, go to “More Services” then “Loan Payoff Amount.”

Alternatively you can contact one of our Member Service Representatives or visit one of our branches.

Providence Federal Credit Union offers several convenient methods by which you can make your credit card payments:

- Pay online with Online Banking

- Make payments from your mobile banking app

- Mail-in Payments:

- Providence Federal Credit Union

6400 SE Lake Road, Suite 125

Milwaukie, OR 97222

- Providence Federal Credit Union

Pay over the phone by contacting us at (888) 849-5189.

You can deposit a check using our mobile app’s Mobile Deposit feature. Tap DEPOSIT in the dashboard (open the dashboard by tapping the blue box with arrows at the bottom of the screen). From there, you can follow the in-app prompts and take a photo of each side of the check to complete your deposit. Just make sure the check is properly filled out, including the endorsement on the back, so that there are no issues or delays in your deposit.

You can activate your card in Online Banking or the PFCU Mobile Banking App, by selecting Cards in the dashboard.

If you need further assistance, call (888) 849-5189 or visit one of our Branches today! If you stop by, please bring a valid photo ID.

No! With Online and Mobile Banking, as well as our robust ATM network, you can conduct business from virtually anywhere!

To dispute a credit card transaction please contact our fraud line at 888-918-7313.

You may need to dispute a credit card transaction if:

- Someone else used your card without permission.

- There was a billing error.

- You’ve tried to resolve a problem with the merchant.

Savings accounts are a great way to save money for the future. Unlike saving in a certificate account or IRA, you have access to your money anytime! Providence Federal Credit Union’s savings accounts offer:

- With a Share Account, you solidify your membership in the credit union and can start taking advantage of the products and services.

- All it takes is $5.00 to open an account and that gives you one share in the ownership of Providence Federal Credit Union.

- When you reach a balance of $100.00 in your share, you’ll begin to accumulate monthly dividend payments.

For more information, visit our Savings Page and see our current saving account rates on our Rates Page.

Yes! We offer the following accounts for minors:

- Cub Account (Newborn to 10 Years Old)

- Cubby Certificate (Newborn to 10 Years Old)

- iPlus Kids Savings Account (11 to 12 Years Old)

- iProsper Teen Account – Savings and Checking (Ages 13 to 17)

See our Kids & Teen Savings Page for more information.

The most secure and safest way to send us your files online is through our Secure File Upload. Through the Secure File Upload, you can send us all membership related documents, including change of address forms, direct deposit forms, pay stubs and driver licenses, and all loan-related documents.

All transfers are confidential and SSL encrypted.

Related Information

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

You can set up travel notices in Online Banking or the PFCU Mobile Banking App. Go to Cards in the dashboard, click on a card and select Travel.

If you do not know your PIN, contact us at 888-849-5189 to select or change your pin. To expedite the process, please be sure to have your debit card available.

The daily wire transfer cutoff time is 1:30 PM.

Please see our Wire Transfer Page for more information.

Related Information

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Providence Federal Credit Union members are able to complete the “Foreign Currency Order Form” found on our Disclosure and Forms page, or fill it out in person at our St. Vincent branch or Milwaukie Branch.

There is a minimum order of $20 USD with our $5 processing fee. Currency can only be picked up at St. Vincent branch, or there is an option of 2 day Fedex delivery for $15, or 3 day Fedex for $20.

We offer the following insurance products:

- TruStage™ Accidental Death and Dismemberment (AD&D) Insurance

- TruStage™ Life Insurance

- TruStage™ Auto Insurance

- TruStage™ Home Insurance

- Guaranteed Asset Protection (GAP) Advantage with PowerBuy™

- Major Mechanical Protection (MMP)

Please visit our Insurance page for more information.

A mortgage note, also known as a real estate lien note, is a signed legal document. By signing, one agrees to repay the loan amount as well as any interest that accrues within a specified amount of time. The interest rate is predetermined.

When you take out a real estate loan, you will also need to sign the mortgage (deed of trust) as well as a promissory note. The promissory note contains the terms of loan repayment, while the deed is released to you upon completion of payment.

Setting up direct deposit is easy! Speak to your HR department about setting up direct deposit. If you are a Providence employee, refer to this link for help setting up direct deposit in Genesis.

Once your direct deposit is set up, you’ll be automatically enrolled in Early Direct Deposit.

To remove an account from your Online Banking account profile, follow the steps below:

- Log in to online banking.

- Click on Secure Message Center (Mail icon)

- Input the account you would like to close.

- Specify where to transfer the funds.

With a savings account from Providence Federal Credit Union you’ll earn dividends on your savings on a monthly basis.

Visit our Rates Page for more information on savings account dividend rates.

There is currently no restriction on the number of times deposited per day. However, total deposits cannot exceed $5,000 per day or $25,000 in any 30 day period.

If you are making a large deposit, please refer to our Funds Availability Policy for information on when the funds will become available in your account.

ATM withdrawals are free for all members of Providence Federal Credit Union. Please note, if you are a non-member you will be charged for use of Providence Federal Credit Union’s ATMs.

PFCU Members also have surcharge-free access to over 120,000 ATMs around the country. Visit any ATM that displays an Allpoint, CO-OP, or MoneyPass logo. Find a surcharge-free ATM right now with our ATM Locator Tool

You may have received a call from our fraud prevention center due to suspicious activity on your card. If they suspect your card security has been breached, they may suspend the usage of your card until you validate the questionable purchases. Contact us now!

Related Information

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Yes! We offer public notary services. There is no charge for members to use this service.

Please bring current photo ID and the documents to be notarized unsigned.

To Schedule an Appointment:

- Click the Appointment icon on the top navigation bar from any page on our website

- Click the Schedule Now button on branch that you would like to visit.

- Select Notary Service and fill out remaining information.

- Select Book at the bottom to finish booking your appointment.

Please note that notary services are not available for the following document types:

- Wills

- Trusts

- Certifying copies

- Mortgage deeds not related to Providence FCU loans

- Vital statistics records & public records

- Photographs

- I-9 forms

- Handwritten documents

Not a thing! You are automatically enrolled. Just relax and enjoy early access to your funds.

Yes! You can apply for pre-approval today.

If you are an established cardholder and either don’t know or have forgotten your PIN for your debit card, please call 800-631-3197. To expedite the process please be sure to have your debit card available.

For new debit card holders, you will be able to set your own PIN at the time of activation or by calling the number on the back of the card (800-631-3197).

The $5 minimum deposit required for membership must remain in your account. However, the more you keep in your savings account the more interest you’ll earn!

For more information on Providence Federal Credit Union savings accounts, visit our Savings Page.

You can set up free automatic bill payments using the Bill Pay feature in Online Banking and the mobile app.

- Log in to your Online Banking account, or Mobile Banking app.

- Click on Move Money in the dashboard.

- Click on the Bill Pay tab.

- From here you can set up one-time, monthly, or automatic payments.

Bill Pay is a free service offered to our members through Online Banking or the Mobile Banking app. It allows you to set up bill payments so that you never miss a due date!

For more information on Bill Pay visit the Bill Pay page of our website.

Signing up for Mobile Banking is as simple as downloading the “Providence FCU Mobile” app from your app store and following the prompts to login. If you are new to online banking, you’ll need to register an account. To do so in the app, tap the “More” button at the bottom and then tap “Register.” You can also register for online banking by following this link. Once registered you can log into the app and begin Mobile Banking!

Notes about our new Mobile Banking App:

Our new and improved mobile banking app is here, as of October 2023. With a new look and feel, the app also has a range of upgraded features and functionality for you to manage your banking on the go.

Apple (iOS) Users:

If you have an Apple iPhone, the new mobile app will update automatically based on your typical app update settings. To be sure the update occurs, we recommend you go into the app store and update to the new version manually. Please note that to support the new mobile banking app, your Operating System (OS) needs to be iOS 14 or higher.

Android Users:

If you have an Android phone, you’ll need to manually download our new free app from the Google Play store. At that time, we also recommend you delete the old PFCU Mobile Banking App. Please note that to support the new mobile banking app, your Operating System (OS) is required to be OS 7.0 (Nougat) or higher.

For Android and Apple users, the new app icon will have a white “P” logo on an orange background:

Please see our Deposit Fee Schedule on our Rates Page for a current listing of debit card fees, like card replacement and rush delivery.

For usage at an ATM you can access nearly 120,000 ATMs across the country for free! Visit any ATM that displays an Allpoint, CO-OP, or MoneyPass logo:

Find a surcharge-free ATM right now with our ATM Locator Tool.

For many care workers, working long hours can make it hard to stay on top of their finances, so we’ve made it easy to join the Credit Union. You don’t even have to leave the house!

Simply enter your Last Name and UDW Member ID into the form on the sidebar of the UDW page to begin your application.

Alternatively you can call us at (888) 849-5189, or go to our San Diego Branch located at 4855 Seminole Drive, San Diego, CA 92115.

You can make credit card payments in Online Banking or the PFCU Mobile Banking App by going to the Move Money tab.

A debit card is linked to your checking account and draws from the available money within the linked account.

A credit card allows you to borrow money from a limited line of credit offered by a financial institution. Each month you will receive a statement specifying your purchase amounts and details, as well as the minimum payment due. If you do not pay off your credit card in full each month you will be charged interest on the money you owe.

You can make a transfer to another account using Online Banking or the PFCU Mobile Banking App.

- Select Move Money from the dashboard in Online Banking.

- Then select Payments and Transfers

- Select the account you want to transfer money from

- Select the account you want to transfer money to

- Enter the frequency that you want this transfer to occur (one-time, recurring, etc.)

- Enter the transfer date

- Enter the transfer amount

- Click submit

The following checks may be declined for mobile deposit:

- Checks that have been altered beyond a signature endorsement

- Checks partially filled out

- Checks that are payable to third parties that are not joint on the account.

You can use Mobile Wallet options such as Apple Pay, Google Pay, and Samsung Pay anywhere you see the universal contactless symbol:

If you would like to use your Mobile Wallet outside of the United States, choose a link below to see which countries support Providence Federal Credit Union Mobile Wallet options:

It’s important to note that we can only guarantee early deposits if your employer or payer provides payment details. Remember that this service depends entirely on receiving your direct deposit information early. If your deposit doesn’t arrive early, you can expect funds to be available on your scheduled payday.

Your account balance is the total amount of money that is currently in your account, including all funds engaged in holds and pending transactions.

Your available balance is the total amount of money in your account that is accessible for purchases and withdrawals. This number does not include held or pending funds.

Please note, available balance does not account for checks that have not been cashed or deposits which have yet to post.

Overdraft fees are determined using your available balance.

To sign in to online banking, access our log in portal on our homepage. You will then need to enter your username and password. If you have not verified the device from which you are logging in, you may need to answer security questions which you established during the enrollment process.

If you have not set up a username, you are able to log in once with your Account Number, at which point you will be prompted to create a username for you to log in with in the future.

Providence Federal Credit Union does not have a SWIFT code. However, we do offer international wires.

We use a routing number instead of a SWIFT code: 323075945. This number is used to complete electronic transfers, bill payments, and set up direct deposit.

Related Information

Make a wire transfer today!

To make a wire transfer, download our International Wire Transfer Request form. Make sure you have the following information:

- Account holder name and full address

- Account number

- Branch number and full address

- Institution number

- Swift Code / BIC / IBAN code (international).

- Routing Number (domestic)

Visit our Wire Transfers page for more information.

Explore our Credit Card page for options to find the best fit for you!

- Visa Platinum

- Visa Classic

- Visa New Beginning

Once you have chosen your new credit card, complete our Online Application process.

We require that our members have full coverage on any vehicle in which Providence Federal Credit Union is the lien holder. If you switch insurance, please remember to send in a new proof of insurance. If insurance lapses, you may be subject to force-placed insurance and any costs associated with it.

For more information, please visit our Insurance page or get your free quote today!

Your mobile deposit will post to your account within one business day. If for some reason your funds are being held for longer than one full business day, refer to our Funds Availability Policy.

To send a secure message log in to your Online Banking account and click on the mail icon in the upper right. Next click New Message, and then compose you message. We also welcome you to send us an email at [email protected].

For security reasons, do not include confidential information such as account numbers or social security numbers in an email. If you are looking to upload secure documents, visit the Disclosures & Forms page and click Upload PFCU Forms.

For further secure and confidential communication, please visit a branch or contact us.

Early Direct Deposit is a free service that comes with your PFCU checking and savings accounts, in which we credit your eligible direct deposit transaction up to two business days early. There’s no enrolling or activating! If we receive your direct deposit information from your employer or payer early, we will deposit your funds into your account. If your deposit doesn’t arrive early, expect it to arrive on your scheduled payday.

Employers or payers may submit their direct deposit information at different times each pay period. Sometimes they may submit it one day early, and other times two days before. We don’t have control over the timing, unfortunately. However, you can sign up for alerts to be notified when you receive your direct deposit early.

To sign up for eAlerts, log into your Online Banking and select Settings in your profile, then Security and click Manage Alerts.

To confirm that your transactions were successful, view your account history in Online Banking.

Any pending transactions will be listed first, followed by the most recent successful transactions.

No. We do not offer business accounts at this time.

The simplest way to check your account balance is through the Accounts tab in Online Banking or the PFCU Mobile Banking App. The Accounts page shows you a overview of each of your accounts, including the current and available balance. By clicking into a specific account you can view recent transactions and even your Account number for that account.

Yes! You can call us at (888) 849-5189 to pay your loan by phone during normal business hours. There is a $10 fee to use this service.

Yes! You can mail a check for deposit to the following address:

- Providence Federal Credit Union

6400 SE Lake Road, Suite 125

Milwaukie, OR 97222

We also offer mobile deposit through our mobile app.

Related Information

Now you can make check deposits from your phone!

All it takes is a few taps and the click of your camera; simple as that. Our Mobile Deposit service is fast, secure, and best of all – free!

For more information and to get started today, visit our Mobile Deposit page.

If you change jobs, you’ll need to set up direct deposit through your new employer.

Yes! Bill Pay is compatible with your PFCU Mobile Banking app. You can find it under Move Money.

Monthly payments can vary based on the loan rate, how much you borrow, and your FICO score.

You can also check out our loan calculators for more help.

There are many possible reasons your login attempts have not been successful. Typically, you can access your account by following the password reset steps below:

- Navigate to the Online Banking login page.

- Click Trouble Signing In?

If you do not have the option to reset your password, your account may be locked. Contact Us for a resolution.

There can be several reasons that a card would be denied. For security reasons, the specifics of your situation must be dealt with in confidence.

Please contact us or visit a branch location to go over your transaction history.

No! We finance both private and dealership sales. For more information on auto loans, visit the Auto Loans page of our website.

To make a loan payment from Online Banking or your Providence FCU Mobile App, go to the “Money” tab where you can transfer your payments manually or set up automatic recurring transfers. You can also set up external accounts to make payments to other financial institutions.

No. You and your financial institution are the only ones who can view your account balances.

If you suspect your Providence Federal Credit Union accounts have been compromised, contact us immediately so that we can assist you in safeguarding your information.

Related Information

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

To discuss deals for first-time home buyers, please speak with one of our Member Service Representatives.

You can check your own credit score for free once annually by visiting www.annualcreditreport.com.

Your credit score is an important part of your financial health, and we encourage members to review their credit report regularly. Here’s what you should look for and what it means to your credit:

- Accuracy – Review the entire report for general accuracy. If you see any accounts that you didn’t open or any errors with existing accounts, you should contact the credit bureau to initiate the process to correct them.

- Inquiries – Your credit report will show who has been accessing your credit report.

A mortgage is a loan to finance the purchase of your home. When you close on a mortgage, your home becomes collateral for the loan. You will be required to sign a legal contract stating that you promise to pay the debt, including interest and other costs, typically over the course of 15 to 30 years.

For more information, please visit our Mortgage page or apply today!

A canceled check is a check which has cleared the depositor’s account and therefore marked “canceled” by the depositor’s financial institution. Copies of canceled checks can be used as proof of payment and are accessible for up to 7 years.

If you are unable to see the check online or you do not use Online Banking, please send us an email at [email protected].

Members can speak directly via a live-feed monitor to a member service representative about a variety of financial services.

These services include:

- Make a Deposit

- Make a Withdrawal

- Make a Loan Payment

- Transfer Funds

- Cashier’s Check

Members can also use an ITM exactly as they would an ATM, by simply inserting their card to bypass the video call features.

Learn more on our ITM Page.

You can have peace of mind knowing that our Bill Pay service meets all security requirements and is thoroughly protected.

For more information on Bill Pay visit our Online Banking page.

A PLOC is what’s known as a revolving line of credit. This type of credit gets its name from how you use it: borrow some, then pay it back, borrow again, pay it back again. You’ll draw from your PLOC by transferring to your checking or savings account with our mobile app.

A HELOC is a revolving line of credit, similar to a credit card. You can borrow as much as you need up to your credit limit, any time you need it. Because a HELOC is a line of credit, you only make payments on the amount you borrow, not on the full amount available to you.

Visit our Home Equity Loans page for more information.

We do not participate in shared branching. However, if you search our ATM locations and find a deposit-taking ATM within our network, you may be able to make a deposit there.

Related Information

Now you can make check deposits from your phone!

All it takes is a few taps and the click of your camera; simple as that. Our Mobile Deposit service is fast, secure, and best of all – free!

For more information and to get started today, visit our Mobile Deposit page.

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

There are several potential reasons your card keeps being denied. For security reasons, the specifics of your situation must be dealt with in confidence.

Please contact us or visit a branch to go over your transaction history.

Deposit times vary depending on when and where you make them. Review our Funds Availability Policy for specific information on deposit availability!

If your deposit does not appear in your account after the appropriate amount of time, visit a branch or contact us.

Related Information

Don’t have Providence FCU Mobile?

Get started with Mobile Banking! It’s super easy. Type Providence FCU into your phone’s App Store or Google Play store and log in with your Online Banking username and password.

Already on your phone? Choose an icon below to get started right now!

Learn more about the convenient features of Mobile Banking.

If you would like to reset your PIN, follow the steps below:

Contact us at 888-849-5189, option 3, then option 4, to reset your PIN.

Yes! Using the Bill Pay feature within Online Banking or the PFCU Mobile Banking App you can set up automatic loan payments. Go to Move Money and then Bill Pay.

To send an international wire, the following information is necessary.

- Account holder name and full address

- Account number

- Branch number and full address

- Institution number

- Swift Code / BIC / IBAN code.

- Routing Number (international)

For more information, visit our Wire Transfers page.

Related Information

Skip the checks and pay all your bills with Bill Pay

With PFCU Bill Pay, you can pay your monthly bills, schedule one-time or recurring payments, save money on buying stamps, and more. Plus, it’s faster than writing checks!

Visit our Bill Pay page to learn more or enroll today through Online Banking.

No, we do not currently offer student loans.

Yes! Providence Federal Credit Union offers Student Loans. for more information and to view current rates visit the Student Loans page of our website.

Related Information

Ready to apply for a Student Loan?

Applying for a loan is quick and easy at Providence Federal Credit Union. Simply fill out the application, select the loan product you’re interested in and we’ll take care of the rest.

For more information on our loan offerings, please visit our Loans page.

Our current stop payment fees are listed on our Fee Schedule.

To place a stop payment, contact us.

Related Information

Haven’t signed up for Online Banking yet?

No problem! With Online Banking, your accounts are just a mouse click or a tap away. Pay bills, transfer money, apply for a loan, check balances, and more; all on your time, from the comfort of your own home.

Visit our Online Banking page to learn more or enroll today!

Credit union members receive a number of benefits including:

- Fewer fees

- Lower loan rates

- Potentially higher rates of return on savings accounts

- Personal attention

- Free financial education

- And more!

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

Any account opened with Providence Federal Credit Union may be viewed in the PFCU Mobile Banking App.

Please note, you will have access to the same information that is typically found through your Online Banking account.

Yes. However, we don’t typically provide that information to 3rd parties without authorization to release. Please Contact Us to speak with a Member Service Representative regarding your loan payoff.

A Fixed Home Equity Loan provides you with a fixed amount of money. You repay the loan with equal monthly payments for a fixed period of time—similar to a mortgage payment.

Visit our Home Equity Loans page for more information.

Based on the value of your home’s equity, we will help determine how much you can borrow. During the draw period, you can advance money as you need it. As you pay off the principle, your available balance is restored, allowing you to use it again. Unlike a fixed-rate loan, you only pay on the balance owed, providing flexibility to use as little or as much as you need.

You can check on the status of your application by clicking the “Check Application Status” link at the very top of our website header, which takes you to this link.

We’re excited to partner with UDW, another not-for-profit organization rooted in understanding the needs and wants of care workers. The care industry and community share a lot in common with the spirit of credit unions – people helping people! PFCU and UDW put members first. Both of us lead by example: to ensure our members are financially protected and successful.

Learn more on our UDW page.

The International Bank Account Number (IBAN) is an international standard of identifying bank accounts. These numbers are used when making or receiving international payments.

The IBAN varies by country/institution and does not replace your account number. Only the institution servicing an account can provide the correct IBAN of that account and it must be obtained from the beneficiary of the wire. An IBAN is required for beneficiary accounts in Europe and other countries around the world.

Related Information

Traveling or shopping abroad?

If you’re preparing to travel out of the country and intend to use your PFCU Visa credit or debit card, notify us as soon as possible! Tell us when and where you’ll be traveling so we can ensure that all your transactions follow your itinerary and that you have easy access to your funds 24/7. The same goes for making purchases online or via phone when making purchases abroad using your cards.

Please give us a call at (888) 849-5189.

Bon, voyage!

You do not need to order through our check vendor. However, we highly recommend taking advantage of our partnership with Harland Clarke! Our vendor provides PFCU members with a variety of affordable check options in many different styles.

Check out the check catalog online and contact Member Care at 888-849-5189 to make your first check order. If you have ordered checks before, re-order your checks online.

We’re grateful to be a part of a community committed to helping those in need, especially when they’re the very people who provide essential services to our communities. For 60 years, our members and employees have volunteered their time and donated their money to serve local organizations including Camp Erin, Kells Green Rain Event, Oregon Food Bank, Portland Festival of Trees and the Providence Helping Hand Fund. We understand the pressures that home health workers and family child care providers can face. That’s why we offer free financial counseling to help you reach your goals. Don’t forget our Care Worker Loan: it can help you get the funds you need, build positive credit, and create savings for your future.

Credit unions are not-for-profit organizations that are owned by the members of that credit union whereas banks are for-profit institutions owned by shareholders.

Because of these reasons, we are able to pass substantial savings on to our members in comparison with other financial institutions. You could save hundreds – perhaps thousands – of dollars each year by using credit union services as opposed to a commercial bank. As a member-owned financial institution, Providence Federal Credit Union returns operating profits to our members, so you can enjoy:

- Fewer fees

- Lower loan rates

- Potentially higher rates of return on savings accounts

- Personal attention

- Free financial education

- And more!

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

Loan approval takes between 24 and 48 hours.

To apply for a personal Line of Credit, simply apply through the link at the top of the Personal Line of Credit page.

No. Our new online banking service does not offer text banking. As an alternative you can set up customizable alerts in Online Banking that will email you when an alert that you’ve set up is triggered.

To check your account balance from your mobile phone, log in to the app and select the Accounts option from the bottom dashboard.

ITM Locations:

Providence Portland Medical Center:

4805 NE Glisan Street

Portland, OR 97213

St. Vincent Medical Center Branch:

9205 SW Barnes Road

Portland, OR 97225

Milwaukie Branch:

6400 SE Lake Road, Suite 125

Milwaukie, OR 97222

View our Contact page to learn more about these locations.

ITMs allow members to speak directly via a live-feed monitor to a member service representative about a variety of financial services. Or they can simply use the ITM exactly as they would use an ATM.

Yes! We offer Mobile Wallet options for Apple Pay, Google Pay, and Samsung Pay.

For more information on mobile wallet, visit the Mobile Wallet page of our website.

Yes. We do offer Motorcycle Loans!

For more information visit the Recreation Vehicle Loans page of our website.

Yes! If you are enrolled in Online Banking, you can access your account information anytime online or on your mobile device in our mobile banking app. Check out the benefits of Online banking here, and enroll today!

Exchange rates are calculated in global currency markets. Fluctuations in exchange rates may occur due to:

- Inflation

- Interest rates

- Budget deficits

- Public debt

- Trade policy

- Political stability

- Economic performance

Related Information

Planning on traveling or shopping abroad?

If you’re preparing to travel out of the country and intend to use your PFCU Visa credit or debit card, please be sure to notify us as soon as possible when you’ll be traveling and where so we can ensure that all your transactions follow your itinerary and that you have access to your funds. The same goes for making purchases online or via phone when making purchases abroad using your cards. You can notify us in Online Banking or the Mobile Banking app by selecting CARDS in the dashboard.

If you are late on a loan payment you will be charged a late fee. For exact pricing, please see our Fee Schedule on our Rates page.

If you write a check and do not have enough money in your account by the time the check clears, the check will be returned to the payee (i.e. “bounced”). Providence Federal Credit Union assesses a Non-Sufficient Funds (NSF) fee in these instances.

Please refer to our up-to-date Fee Schedule for exact pricing.

Follow these guidelines to ensure that your checks always clear:

- Never write checks without available funds

- Balance your checkbook regularly

- Obtain Overdraft Protection through Providence Federal Credit Union

- Monitor your available balances via Online Banking.

Yes, however, there is a penalty for withdrawing from your certificate account early:

Your Certificate account will mature on the maturity date set forth on your Account Receipt or Renewal Notice. We may impose a penalty if you withdraw any of the principal of your Certificate before the maturity date. (1) Amount of Penalty. The amount of the early withdrawal penalty is 90 days dividends calculated on the balance at the time of withdrawal. (2) How the Penalty Works. The penalty is calculated as a forfeiture of part of the dividends that has been or would be earned at the nominal dividend rate on the account. It applies whether or not the dividends have been earned. In other words, if the account has not yet earned enough dividends or if the dividends have already been paid, the penalty will be deducted from the principal. (3) Exceptions to Early Withdrawal Penalties. At our option, we may pay the account before maturity without imposing an early withdrawal penalty under the following circumstances: When an account owner dies or is determined legally incompetent by a court or other body of competent jurisdiction. Certificate accounts are automatically renewable accounts. Automatically renewable accounts will renew for another term upon maturity. You have a grace period of seven (7) days after maturity in which to withdraw funds in the account without being charged an early withdrawal penalty. Your account is nontransferable and nonnegotiable. The funds in your account may not be pledged to secure any obligation of an owner, except obligations with the Credit Union.

To learn more, or to explore other options, contact us today.

Yes! We do offer Safe Deposit Boxes. However, they are currently only available at our St. Vincent’s Branch location.

For more information on pricing visit the Fee Schedule.

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

We offer two types of Home Equity Loans:

- Home Equity Line of Credit (HELOC)

- Fixed Home Equity

Visit our Home Equity Loans page for more information.

Please contact the person or company that wrote the check to alert them of the issue. This issue typically occurs when the checking account from which the funds were being withdrawn does not contain sufficient funds to cover the check.

Follow these guidelines to ensure that the checks you write always clear:

- Never write checks without available funds

- Balance your checkbook regularly

- Obtain Overdraft Protection through Providence Federal Credit Union

- Monitor your available balances via Online Banking.

Our Home Equity Line of Credit (HELOC) offers the following benefits:

- Variable-rate with up to 22-year term

- Low fees with affordable repayment terms

- Borrow up to $300,000 (up to 90% of your assessed or appraised value)

- Tap into the line of credit any time you need it

- Direct Deposit and Payroll Deduction Payments to fit your unique pay schedule

- Interest paid may be tax-deductible

Please refer to the HELOC page for more information.

First, you’ll be approved for a total loan amount you can borrow. This loan is a one-time lump sum that comes with a fixed payment amount and number of payments over the term, making it easier to plan your monthly budget.

Related information

It’s time to hit refresh on your kitchen, bathroom, or backyard

Find the funds you need right in your own home with a Home Equity Loan or Line of Credit.

Is the credit union insured by the Federal Deposit Insurance Corp. (FDIC), like banks and thrifts?

Unlike Banks and Trusts which are insured by the FDIC is centered around Banks and Trusts, credit unions are insured by the National Credit Union Administration (NCUA) instead. Both institutions insure accounts up to $250,000. The difference is that the NCUA covers regular shares and share draft accounts which are specific to credit unions and the $250,000 coverage limit applies to total deposits at a single institution.

Related Information

Not a member yet?

Becoming a member is oh so easy! At Providence FCU, we exist to serve the needs of our members. Not only will you receive exceptional service, you will also become a part of the greater credit union movement and community; not to mention all the great perks that come with PFCU membership! But shhhh…that’s our little secret.

Click here to become a PFCU family member today!

This situation is evaluated on a case-by-case basis. Please contact us for assistance.

No, we do not currently offer business loans. However, we do offer several other loans to fit your needs. Visit our Loans page for more information.

Related Information

Apply for a loan today!

Applying for a loan is quick and easy at Providence Federal Credit Union. Simply fill out the application, select the loan product you’re interested in and we’ll take care of the rest.

For more information on our loan offerings, please visit our Loans page.

To begin, make sure the merchant you would like to purchase from accepts Apple Pay. If they can accept your Apple Pay payment, they will have one or both of the following icons on their terminal:

If you would like to pay with an iPhone with Touch ID, just place your finger on Touch ID and hold the top of your iPhone near the contactless reader until you see Done and a checkmark on the display.

If you would like to pay with Apple Watch, double-click the side button and hold the display of your Apple Watch near the contactless reader. Wait until you feel a gentle tap. A subtle vibration and beep will let you know your purchase was successful.

If you are paying online or in App, simply tap the Apple Pay button and follow the on-screen prompts to complete the transaction.

Currently, you cannot view check images through Online or Mobile Banking. If you must access check images, email [email protected]. We retain digital copies for a year

Related Information

Take steps toward your financial wellness with PFCU!

At Providence Federal Credit Union, we believe empowering members with the tools and resources to make smart financial decisions is a critical component to living a healthier financial life. With their years of experience in the financial industry, our Financial Coaches are here to provide a customized experience for you that will support your financial goals.

Schedule a one-on-one financial coaching session with one of our certified financial counselors.

If you are receiving this message, your card may be blocked, or you may need to reset your PIN.

Please Contact Us or visit a branch today for further assistance.

Related Information

Thinking about your account security? We are too!

While we have state-of-the-art systems in place to ensure that your information stays safe, it’s important that you also arm yourself with the knowledge to help prevent falling victim to a fraudster’s schemes. We want to give you the tools you need to stay informed and up-to-date.

To learn more on how you can protect yourself, please visit our Security page.

If you suspect your accounts have been compromised, Contact Us right away!

Please review our Fee Schedule for our current Card Replacement Fee.

Lost your Card?

If your card has been lost or stolen contact Visa Card services immediately at (888) 849-5189 .

Related Information

Visa benefits just for you from PFCU!

If your credit card company has increased your rates, bumped up your minimum payments, or hiked up their late fees, then check out our Visa Programs. You’ll find low rates, low or absolutely no fees, and easy access to your money.

For more information, please visit our Credit Cards page or apply today!