Online Banking

Simple, secure, and easy-to-use

PFCU’s online and mobile banking platform provides a personalized dashboard, enhanced security, live chat support, and other great features to make managing your money effortless.

Exciting Features

Live Chat

All-In-One Mobile App

Free Credit Score

Card Services

Language Support

Accessibility

Tips for Mobile App Users:

Updating your operating system is highly recommended to provide the best experience when using our new mobile banking app. If you have an Apple iPhone, the new app requires the Operating System (OS) to be iOS 14 or higher. Android phone users need an Operating System of OS 7.0 (Nougat) or higher.

Apple (iOS) Users:

The new app will update automatically based on your typical app update settings. To be sure the update occurs, we recommend you go into the app store and update to the new version manually.

Android Users:

After October 10, you’ll need to download the new app from the Google Play store. At that time, we also recommend you delete the old PFCU Mobile Banking App.

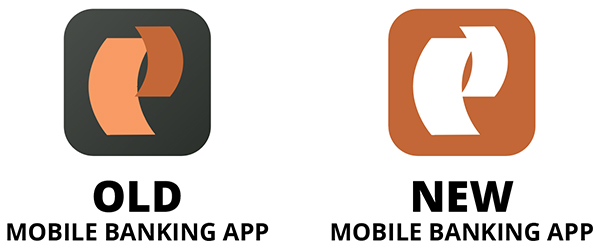

For both Android and Apple users, the new app icon will have a white “P” logo on an orange background:

Free Online Bill Pay

Bill Pay is a free service offered to our members through Online Banking or the Mobile Banking app. It allows you to set up bill payments so that you never miss a due date!

- Save time from writing paper checks

- Save money on buying stamps

- Make one-time payments

- Schedule recurring payment

Setting up Bill Pay

You can set up free automatic bill payments using the Bill Pay feature in Online Banking and the mobile app.

- Log in to your Online Banking account, or Mobile Banking app.

- Click on Move Money in the dashboard.

- Click on the Bill Pay tab.

- From here you can set up one-time, monthly, or automatic payments.

Find Account & Routing Numbers

- Click on “More Services” in the dashboard.

- Then click on “Routing & Account Numbers.”

- Here you will find Account, Routing and MICR numbers for your accounts (you may need to click on the “eyeball” icon to reveal).

Enrolling in Free eStatements

Ready to go paperless? We make it easy!

Online Banking:

- Sign in to Online Banking.

- Select “Statements” from the left side menu of your accounts page.

- Select the “Manage Preferences” tab.

- Under “Go Paperless?”, toggle the button.

- Read the terms and click “I accept the Terms & Conditions” button.

- Now you’ll see the “Delivery: Mailed” has been changed to “Delivery: Emailed”.

Mobile Banking:

- Sign in to Mobile Banking.

- Select “Statements” from the bottom menu.

- Select the “Manage Preferences” tab.

- Under “Go Paperless?”, toggle the button.

- Read the terms and click “I accept the Terms & Conditions” button.

- Now you’ll see the “Delivery: Mailed” has been changed to “Delivery: Emailed”.

Frequently Asked Questions

Yes! To view your tax documents through Online Banking go to Statements in the dashboard (the dashboard is on the left side in Online Banking and at the bottom in the Mobile app).

Tax forms will be sent out each year at the beginning of February.

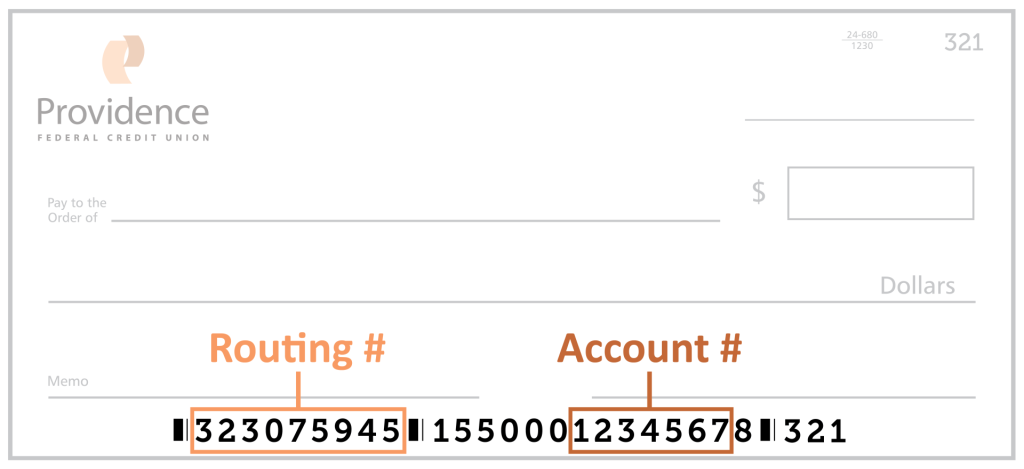

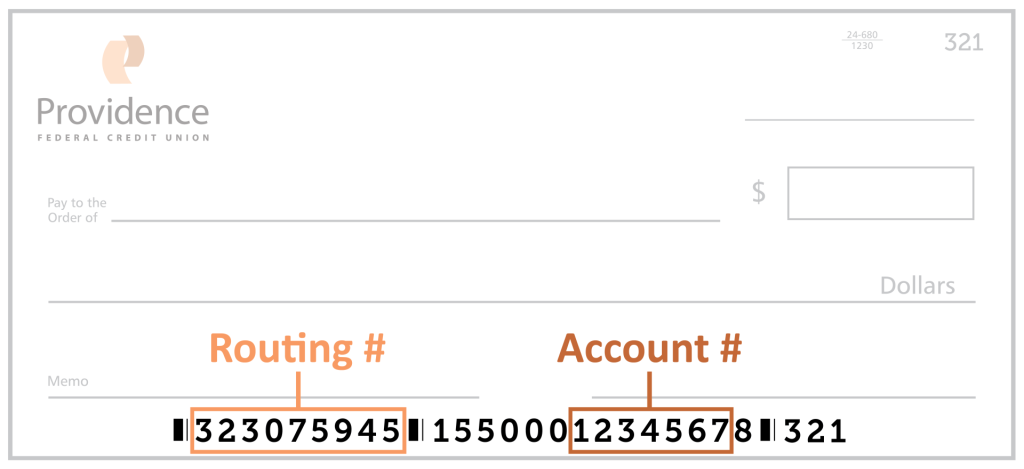

Providence Federal Credit Union’s routing number is 323075945, and can always be viewed at the bottom of our website, or the bottom left of your checks.

This information, along with Account Numbers, can be found in Online Banking by going to More Services and then Account and Routing Numbers.

You may be wondering, what is a routing number anyway? Good question. A routing number is a 9-digit code used to identify financial institutions in electronic transactions.

Adding an external account is easy through Online Banking or our Mobile Banking App. Simply go to Move Money in the online banking dashboard. Then select Manage Destinations, and then Add External Account. Connect your account through the Plaid portal by following their on-screen prompts. Plaid will likely need to initiate a withdrawal and then deposit of a $0.01 micro transaction to connect the accounts.

After the process is complete this account will be an available option when selecting where to transfer funds in the Payments & Transfer section of Move Money.

Update contact information in Online Banking or the Mobile Banking app

When logged in to Online Banking, click on the circle with your initials in the upper right corner. From the dropdown, click on “Settings.” From the “Personal Information” tab you can update your email, phone number, and address. Simply click on the pencil icon for the corresponding section you would like to update. Remember to also click the check mark icon when you are ready to save your changes.

Account Change Form

If you need to update your name, or other settings that aren’t found in online banking (like beneficiaries or joint account holders) please fill out the Account Change Form via DocuSign. You will need to upload images of a valid government issued ID. This form can also be completed in person, just be sure to bring your valid government issued ID with you.

If you are enrolled in eStatements, you will receive an email when your statement or notice is available. If you are not enrolled in eStatements, you will receive your statement in the mail at the address you provided when signing up with Providence Federal Credit Union.

To view your statements, or enroll in eStatements go to the Statements tab in the online banking dashboard, or mobile banking app.

Within Online Banking, you can view and print statements for up to 18 months. If you would like a copy of a statement prior to this timeframe, contact a Member Service Representative at [email protected].

In order to enroll in eStatements you must first be enrolled in Online Banking. When enrolling you will be asked if you want to opt-in to eStatements.

If you are already enrolled in Online Banking and would like to switch to eStatements you can do so by clicking on Statements inside Online Banking. From there you can select Manage Preferences and then toggle Enable All to go paperless and begin receiving your monthly statements via email.

You can deposit a check using our mobile app’s Mobile Deposit feature. Tap DEPOSIT in the dashboard (open the dashboard by tapping the blue box with arrows at the bottom of the screen). From there, you can follow the in-app prompts and take a photo of each side of the check to complete your deposit. Just make sure the check is properly filled out, including the endorsement on the back, so that there are no issues or delays in your deposit.

You can set up free automatic bill payments using the Bill Pay feature in Online Banking and the mobile app.

- Log in to your Online Banking account, or Mobile Banking app.

- Click on Move Money in the dashboard.

- Click on the Bill Pay tab.

- From here you can set up one-time, monthly, or automatic payments.

Bill Pay is a free service offered to our members through Online Banking or the Mobile Banking app. It allows you to set up bill payments so that you never miss a due date!

For more information on Bill Pay visit the Bill Pay page of our website.

You can transfer money to your accounts at another financial institution using electronic transfers in Online Banking.

- Log in to your account.

- Select Move Money.

- Click Manage Destinations.

- Click Add External Account.

- Follow the prompts with Plaid to enter your external account information and submit the transfer.

Electronic transfers can be made from your savings, checking or credit card accounts.

NOTE: Beginning June 2, 2025, the process for finding your account number will be slightly different, but for most of our members there will be no changes to your account number.

There are 3 ways you can find your account number:

1. Online Banking or Mobile Banking

- Log Into Online Banking or the Mobile Banking App.

- Select “More Services” from the main menu dashboard.

- Then select “Routing & Account Numbers.”

- To reveal your full account number, you may need to click the toggle above the account name.

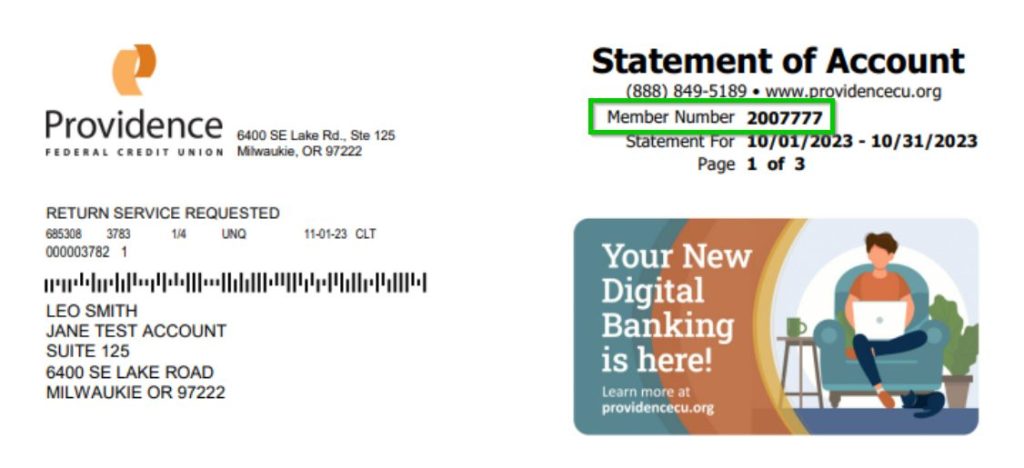

2. Bank statements (paper or electronic)

Your account number is listed as “Member Number” on the upper right of your monthly paper or eStatements.

3. Checkbook

The middle section of the bottom row of numbers contains your account number. View the check image below for an example.

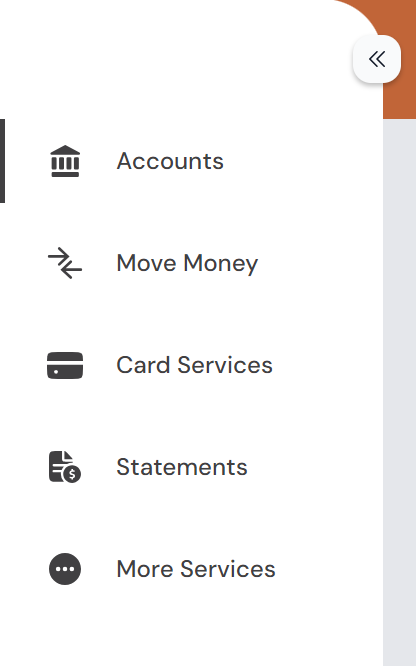

In order to access the dashboard in Online Banking and Mobile Banking, first tap or click on the double arrow icon on the left side of the screen (or the bottom of the screen in the Mobile Banking app).

With the dashboard open you have access to five sections:

1: Accounts

Use the accounts section to view all your account balances and account information, like recent transactions and account numbers. You can also perform quick transfers in the Accounts section.

2: Money Money

The Move Money sections handles all sorts of payments and transfers. You can set up Bill Pay, schedule recurring payments, connect external accounts, and request cashier’s checks.

3: Card Services

Card Services is where you can manage your various debit and credit cards. You can temporarily lock your card, report it missing or damaged, and even set up travel notices.

4: Statements

In Statements you can view eStatements, eNotices and tax documents. This is also where you manage your statement preferences, like choosing to receive your monthly statements in the mail or via email.

5: More Services

There is a lot to explore in More Services. You can set up overdraft protection, view account information, order checks, and open accounts. Loan Services options are also available here, including loan payments, rates and applications. This is also where you can book appointments.

If you have more questions about the dashboard or the various features within Online Banking be sure to visit our Online Banking page, or reach out to us with questions.

You can set up customized Alerts in Online Banking or the Mobile Banking app to receive notifications about various account activities.

Go to the “Settings” tab (upper right profile icon), select “Security and Alerts” and then “My Alerts.” From here you can “Add New Subscription” to customize the alerts you would like to receive. You can also manage existing alerts on this screen.

“

”

Need more information?

Connect with a PFCU Member Consultant, by scheduling an appointment, email, or phone.